|

|

|

Legacy

100 Years of Jewelry

By Phyllis Schiller

|

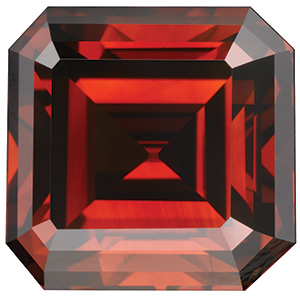

| 5.05-carat Kazanjian red diamond, currently on display at the American Museum of Natural History in New York City. Photograph by Tino Hammid, Los Angeles. |

Kazanjian Beverly Hills has built its reputation as a buyer of important gemstones and estate jewelry over the course of four generations. As the family celebrates its 100th year in the jewelry business, Rapaport Magazine spoke with company chairman Michael Kazanjian about the changes he’s seen in the estate jewelry business.

Rapaport Magazine: 100 years in the jewelry business is impressive — how has the company evolved?

Michael Kazanjian: My grandfather, Charles Kazanjian, was a goldsmith and coppersmith, working in Turkey. Around 1913, the family decided to emigrate to America. Along the way, they went through Paris, where my uncle Harry was refused passage on the boat to America because of an eye infection. He had to remain in Paris and lived with an uncle who was a gem cutter, and that’s where the family continued its involvement with jewelry. My uncle began cutting stones for firms like Mauboussin, Boucheron and Cartier, and by the time he came to America, he was an accomplished stone cutter. He and my father, James, started the business in Springfield, Massachusetts, in 1918. They came out to California in 1928 and we’ve been here ever since.

In the 1960s, my brother Stanley and I joined the business. When we came into the company, we brought an interest in diamonds and manufacturing, and later on, the acquisition of private collections and estates. My son Douglas is the current CEO (chief executive officer). People often ask us, “How can you have a family business that survives?” My answer is that for a business to survive, it has to be redesigned around the people who are going to be running it. At some point, the patriarch has to turn the reins over to the generation that is going to follow. A family business can survive if it puts family first and allows the next generation to redefine and reexamine the business so that it continues to grow. And I think we’ve done that pretty successfully.

RM: How has the estate jewelry business changed over the decades since you began buying private collections?

MK: I think there’s more of an interest today than there has been at any other time in the past. And many of the retailers we do business with are putting estate jewelry sections in their stores so they can give their clients an alternative to buying a signature designer piece made today.

In other parts of the world, jewelry is purchased as much for the pride of having it within the family as for a source of value or investment. The turnover of estate jewelry in parts of Asia or even Europe is minimal compared to the way it turns over in the United States. So the whole world ultimately shops here, which makes the American estate market a very wonderful place.

RM: The Kazanjian Foundation has been associated with some impressive estate pieces. What is the idea behind this?

MK: My father sold some of the very large stones he had found around the world and used the money to support various charitable causes, such as The Gemological Institute of America and the Children’s Hospital of Los Angeles. When he died in 1988, we decided to make a donation to the foundation of a collection we had been accumulating for many years of estate pieces that had been owned by celebrities — Clark Gable, Joan Collins, Madonna, to name a few — and created the Jewels for Charity Hollywood Collection. Donors get the highest write-off the law provides for the jewels they donate. If someone donates a $20,000 pin, when it’s sold, $20,000 goes to charity. The Jewels for Charity Hollywood Collection tours around the country to fine jewelry stores and galleries that wish to do an event for a particular cause. As pieces get sold, the charity gets the benefit and it’s something that jewelers can use to attract people to their stores. It works very well for everybody.

RM: Do you think consumers are more interested in estate jewelry and is it making it more difficult to source prime pieces?

MK: The economic crisis in this country has stimulated the estate market and made it more active than it might have been had we been in the same kind of rising times we enjoyed previously. Jewelry is a convertible asset. More and more people are looking at jewels for the value they represent over and above artistic and emotional qualities. There are more people chasing the finer pieces. And this has added a premium to the signed jewels and they are harder to find.

RM: What are the types of collections that you go after and how do you find them?

MK: One-of-a-kind jewelry with important stones is always desirable, but those pieces are in short supply. We work with banks, attorneys and stores around the world that take in estate collections. We give them an alternative to the auction process by writing a check for x dollars as opposed to the auction house that offers to sell it for between x and y dollars. The auction houses have done a wonderful job of creating an appetite and a facility for marketing great jewelry. We’re an alternative that we think works as well or better.

There are always pieces that heads of countries and celebrities own that we would certainly dream to have. But we have to wait for the proper introduction and the proper time to have an opportunity to make a bid. That’s how we got our great red diamond, through a private family who was referred to us. You don’t know until it happens if something wonderful is going to walk through the door. For us, it’s a treasure hunt. Where originally, we would go to the mines and acquire the rough stones, today we “mine” for jewels in the estate jewelry arena. Article from the Rapaport Magazine - October 2013. To subscribe click here.

|

|

|

|