|

Industry

Diamonds According to Bain

Antwerp commissions another report on the future of the global diamond industry.

By Marc Goldstein

For the third consecutive year, the Antwerp World Diamond Centre (AWDC) commissioned global consulting firm Bain & Company to prepare a report on the state of the diamond industry and project its future over a ten-year period. This year’s focus was on the industry’s value chain and how the different segments of that chain are faring.

Clearly, the Bain report is designed to cover more than just the small world of the diamantaires, and sections of the report address topics familiar to diamond producers, manufacturers and dealers. The scope of the work extends from the extracting stage, when diamonds are pulled from the earth, to the retail stage, when diamonds and diamond jewelry find their way into the hands of consumers.

One of the major merits of the report is that it collects the statistics to confirm and give credibility to many theories and assumptions about the industry that those who work in it feel they already know, just from their gut instincts or through access to empirical or partial information.

For those who were skeptical about the diamond industry’s future, the report confirms that there is a future. Barring improbable and unpredictable global catastrophes, demand for diamonds will continue to rise, both in terms of numbers and value. What the report refers to as high-net-worth individuals (HNWIs) — basically the emerging middle class — is undoubtedly going to increase and the pace of HNWI growth will ensure that there will be more and more people willing and able to afford the higher prices that will be charged for diamonds. Except for Europe, where the trend will take a little longer to affirm itself, signs of growth are showing almost everywhere, including in the U.S. and in Japan.

Within the framework of diminishing supply and increased demand, it’s inevitable that the prices of rough will keep increasing globally and those of polished diamonds will have to follow. In light of that scenario, the major question screaming in every company manager’s ears, regardless of the business size, goes as follows: “There will be room and business in the future certainly, but not for everyone, unfortunately. How can we ensure there will be a future for us?”

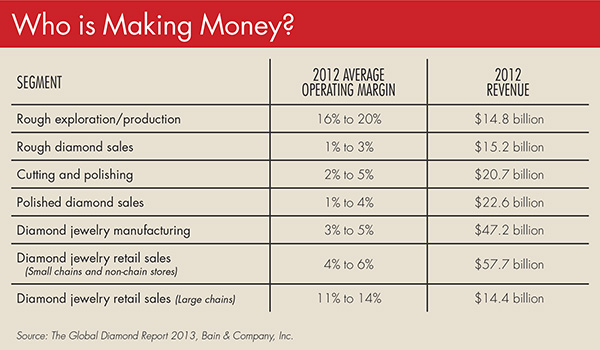

One recent phenomenon in the diamond industry has been the vertical integration through the pipeline. This integration reflects the widely disparate operating profit margins for the different segments of the industry pipeline and the attempt by industry players to improve those margins by extending their reach into more profitable sectors. Assuming an average inflation rate of 2.5 percent, it is obvious that many companies operating in the diamond manufacturing/trade and in the diamond jewelry manufacturing sectors of the industry have been either losing money or making profit far out of sync with their investment. Here, then, are the highlights of Bain’s look ahead.

ROUGH SUPPLY: A balanced market over the next four years, with a growing gap between supply and demand longer term.

The rough diamond market is expected to remain balanced from 2013 through 2017. From 2018 onward, as existing mines get depleted and no major new deposits come online, supply is expected to decline, falling behind expected demand growth that will be driven by China, India and the U.S. Over the subsequent ten-year period, supply and demand are expected to grow at a compound annual rate of 2 percent and 5.1 percent, respectively. The supply-demand outlook carries different implications for industry players at different points along the value chain, and it will impact the way they manage their business activities over the next four years and in the longer run.

MINING: A focus on operational excellence, strengthening the asset portfolio and adjusting the development pipeline.

With stable market conditions over the next four years, mining companies are likely to focus on maintaining healthy balance sheets, attaining operational excellence and investing in technology to improve productivity. Given the supply-demand balance outlook, mining companies are also expected to carefully review their development pipelines to identify the projects that promise the highest returns.

MIDDLE MARKET: Continuing consolidation.

The highly fragmented middle market — with more than 5,000 players — has traditionally garnered the lowest margins along the diamond value chain, with some companies earning as little as 1 percent to 2 percent. Further consolidation and integration is expected in the middle of the value chain in order to maximize margins through scale and scope.

RETAIL: Ensuring security of supply.

Diamond jewelry retailers will be looking to capitalize on the growing demand for diamonds. Their key challenge will be to secure an adequate and consistent supply of polished diamonds in the range of sizes, shapes and colors suited to their product lines. A number of premium retailers have already integrated backward along the value chain by investing in mining assets and cutting and polishing operations and securing access to primary rough supply. This trend is expected to continue.

Article from the Rapaport Magazine - November 2013. To subscribe click here.

|

|