|

Industry

Antwerp Tightens Up

With the increasing global need for transparency, the diamond industry is being held more accountable.

By Marc Goldstein

It’s not completely accurate to speak about Belgium’s new antimoney-laundering (AML) legislation. Indeed, what is known as the preventive part of the law was introduced in Belgium as far back as January 11, 1993, and 11 years later, on January 12, 2004, the legislation was extended to diamond traders.

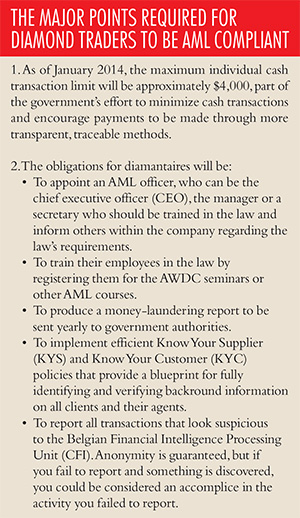

What’s new today is that the European and Belgian authorities are beginning to enforce those laws within the diamond industry with much more severity than in the past. As part of that enforcement, the fiscal authorities have set up a specialized diamond unit that has already started moving from diamond company to diamond company to help implement controls. During the first round of visits, the diamantaires were essentially informed of the mistakes that were found and weren’t, reportedly, fined for any violations. But the message the visits of the authorities sent to the industry was that very soon, the tolerance level would go down to zero.

Legally, money laundering includes the notion of conscious involvement. This means the people “should have reasonably known” that, one way or another, they were involved in money laundering. According to the law, money laundering occurs when participants transfer, use, hide, store or take into custody, for any reason whatsoever, money or assets of illegal origin. AML extends to money that finances terrorism, organized crime and drug trafficking, as well as serious and organized tax fraud and misuse and abuse of corporate assests.

A freelance accountant working exclusively for diamond companies explained anonymously that “The big difference between now and what used to be is that in essence, they’re making all of us accessories to the system. They’re forcing diamantaires to get adequate training in the AML requirements so that, should anything out of line with those requirements be discovered, they are likely to be considered responsible. And the Sword of Damocles that’s now hanging over our heads is most certainly not a joke. Just the monetary fines for violations of the AML law can reach up to $1.7 million, and that doesn’t even include the criminal aspect of violations, which also can lead to severe sanctions.”

It’s not completely accurate to speak about Belgium’s new antimoney-laundering (AML) legislation. Indeed, what is known as the preventive part of the law was introduced in Belgium as far back as January 11, 1993, and 11 years later, on January 12, 2004, the legislation was extended to diamond traders.

What’s new today is that the European and Belgian authorities are beginning to enforce those laws within the diamond industry with much more severity than in the past. As part of that enforcement, the fiscal authorities have set up a specialized diamond unit that has already started moving from diamond company to diamond company to help implement controls. During the first round of visits, the diamantaires were essentially informed of the mistakes that were found and weren’t, reportedly, fined for any violations. But the message the visits of the authorities sent to the industry was that very soon, the tolerance level would go down to zero.

Legally, money laundering includes the notion of conscious involvement. This means the people “should have reasonably known” that, one way or another, they were involved in money laundering. According to the law, money laundering occurs when participants transfer, use, hide, store or take into custody, for any reason whatsoever, money or assets of illegal origin. AML extends to money that finances terrorism, organized crime and drug trafficking, as well as serious and organized tax fraud and misuse and abuse of corporate assests.

A freelance accountant working exclusively for diamond companies explained anonymously that “The big difference between now and what used to be is that in essence, they’re making all of us accessories to the system. They’re forcing diamantaires to get adequate training in the AML requirements so that, should anything out of line with those requirements be discovered, they are likely to be considered responsible. And the Sword of Damocles that’s now hanging over our heads is most certainly not a joke. Just the monetary fines for violations of the AML law can reach up to $1.7 million, and that doesn’t even include the criminal aspect of violations, which also can lead to severe sanctions.”

|

In order to facilitate the industry’s adaptation to the new legal requirements, the Antwerp World Diamond Centre (AWDC) created a Client Acceptance Policy (CAP) document, which was made available to all diamantaires who registered for and attended its AML seminars. At the conclusion of the seminar, attendees received an AML training certificate. On the one hand, the certificate has its importance, given it serves as proof of completion of the training that is one of the law’s major requirements. The problem is that seminar participants in a way end up knitting themselves the rope with which the tax authorities could hang them. If they are found guilty of violations of the law, the certificate holders could easily be told that they “were aware and knew.” On the other hand, if the diamond manufacturers and traders skip the AML seminars, they end up being in violation of the law, since the training is compulsory. Obviously, there’s not much of a choice.

Another accountant summarized how he sees the situation. “The tendency is that the actors become cops and potentially can be convicted if the fiscal authorities can prove that you’re not a good cop!” He was referring to the fact that diamantaires who receive the training will be expected to police themselves and the industry for money-laundering violations and may even be subject to prosecution on the basis that they were aware of the regulations in the first place.

Under the seal of anonymity, the top executive of one of the Antwerp diamond bourses elaborated. “Of course, we’re not comfortable with all this. You must understand that there’s the law and the spirit of the law. We, as diamantaires, all agreed that our trade had to be monitored one way or another to help get rid of blood diamonds. This is what was indeed rooted in the United Nations decisions that led to this legislation. However, at this stage, we don’t know exactly how the fiscal authorities are going to use all this extra power the government is giving them. They have to understand that an industry such as ours relies upon a very delicate equilibrium. We have severe competition abroad and our business is extremely footloose,” he said, referring to the fact that the industry can quickly move its assets to another location should legislation become too abusive or intrusive.

In their argument for less restrictive regulation, Antwerp diamantaires often cite the example of France, where the presidency of François Hollande has placed such fiscal burdens on the population that many of the more innovative people and entrepreneurs are leaving the country to establish themselves abroad. Increasing the level of enforcement in Antwerp, even though it may be laudable, is inevitably likely to create a further distortion of competitiveness with respect to other “more permissive” diamond centers.

It still may be too early to tell what the spread will be between the law and the spirit of the law. There’s a reasonable degree of fear because nobody knows exactly to what extent diamantaires will be held accountable for the fraud cases they might encounter. A diamond manufacturer concluded, “It’s all a question of due diligence: where does that end exactly? We understand that there’s a need for clarity, but we can’t all become sheriff’s deputies and spend unreasonable amounts of time on that. We have businesses to run as well.”Article from the Rapaport Magazine - December 2013. To subscribe click here.

|

|