|

|

Certified Diamond Prices Decline 0.7% in November

Dec 4, 2012 8:01 AM

By Rapaport

|

|

|

RAPAPORT... PRESS RELEASE, December 4, 2012, New York: Certified polished diamond prices edged down in November as the holiday season started with mixed prospects for the jewelry sector. Diamond dealers were active but retailers continue to efficiently manage their already sufficient inventory levels, with little promise for significant restocking in the New Year.

Superstorm Sandy and the presidential elections impacted U.S. sentiment at the start of the month but spending improved over the Thanksgiving weekend, despite the unresolved ''fiscal cliff'' negotiations. There are rising concerns that potential tax increases will reduce luxury spending. Global economic uncertainty continues to impact jewelry sales in China, particularly mid- to high-end purchases. India’s Diwali festival was satisfactory for jewelers but high rupee-based gold prices have since reduced spending.

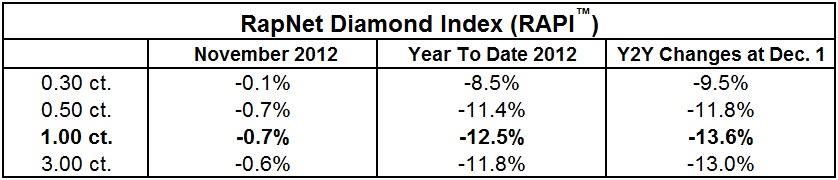

The RapNet Diamond Index (RAPI) for 1 ct. diamonds fell 0.7 percent during November 2012. RAPI for 0.3 ct. stones was down 0.1 percent for the month, while RAPI 0.5 ct. diamonds declined 0.7 percent. RAPI for 3 ct. stones dropped 0.6 percent.

During the first 11 months of 2012, RAPI for 1 ct. diamonds fell 12.5 percent. The index is down 13.6 percent from one year ago.

Copyright © 2012 by Martin Rapaport

According to the just released Rapaport Research Report, “Holiday Promise,” polished diamond markets were active in November. There is decent demand for VS2-SI clarity goods and strong demand for smaller size fancy shapes as price sensitive buyers shifted to lower price points.

Rough trading has been relatively quiet as Indian diamond cutting factories were closed for most of November during the Diwali festival and subsequent wedding season. Rough prices held relatively firm during the month as De Beers and ALROSA reduced supply. Small and mid-size mining companies noted improved prices following a weak third quarter.

Diamond markets are expected to continue to tread cautiously in the short term with December trading focused on filling last-minute orders before the end-of-year quiet period. Holiday sales may deplete some retail inventory and jewelers are unlikely to start significant inventory build-up in January. While the diamond market searches for a bottom, trading is expected to continue at the slightly depressed levels that have been prevalent for most of 2012.

Read the Rapaport Research Report, “Holiday Promise”, at www.diamonds.net/reports or email: specialreports@diamonds.net.

Rapaport Media Contacts: media@diamonds.net

International: Shira Topiol +1-702-425-9088 <> U.S.: Sherri Hendricks +1-702-893-9400 <> Mumbai: Manisha Mehta +91-97699-30065 <>

About the Rapaport - RapNet Diamond Index (RAPI™): The RAPI is based on the average asking price in hundred $/ct. for the top 25 quality 1 ct. round diamonds (D-H, IF-VS2, RapSpec-2 and better) with GIA grading reports offered for sale on RapNet – Rapaport Diamond Trading Network. The RAPI is provided for various sizes. www.RAPNET.com has daily listings of over 970,000 diamonds valued over US$6.1 billion and 7400 members in over 80 countries.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added value services that support the development of free, fair and competitive global diamond markets. Established in 1978, the Rapaport Diamond Report is the primary source of diamond prices and market information. Group activities include publishing, research and marketing services, internet information and diamond trading networks, global rough and polished diamond tenders, diamond certification, quality- control, compliance, shipping, and financial services. Major activities of the group include the development of markets for Fair Trade Diamonds and Jewelry as well as the creation of diamond futures markets. Additional information is available at www.Rapaport.com.

Martin Rapaport (Publisher) grants limited permission to use copyrighted data appearing in this press release in and in conjunction with journalistic copy, reporting or articles concerning diamond pricing and information in graph or data presentation format only. The following credit notice must appear alongside, underneath, or in close proximity to any use of the copyrighted data: “Used with permission of Rapaport USA, Inc. Copyright © Martin Rapaport. All rights reserved.”

|

|

|

|

|

|

|

|

|

|

Tags:

Rapaport, Rapaport

Diamonds

RAPI

RapNet Diamond Index

RapNet

Martin Rapaport

|

|

|

|

|

|

|

|

|

|

|

|

|