RAPAPORT... Harry Winston Diamond Corp’s sale of its luxury brand to Swatch Group is the most significant step yet taken by this rapidly evolving company. Essentially, the deal marks the end of Harry Winston the mining company, as the brand returns to its luxury roots, and the mining business is renamed Dominion Diamond Corporation.

The move itself did not surprise the market so much as its swift timing, coming less than two months after Harry Winston agreed to buy the Ekati mine from BHP Billiton. In November, CEO Bob Gannicott dismissed market rumors of a pending luxury deal saying an eventual sale wouldn’t happen for at least another year.

But clearly Gannicott and his soon-to-be-named Dominion see more upside potential in being on the supply side of the market than on the demand side and are eager to get on with the business of digging diamonds out of the ground.

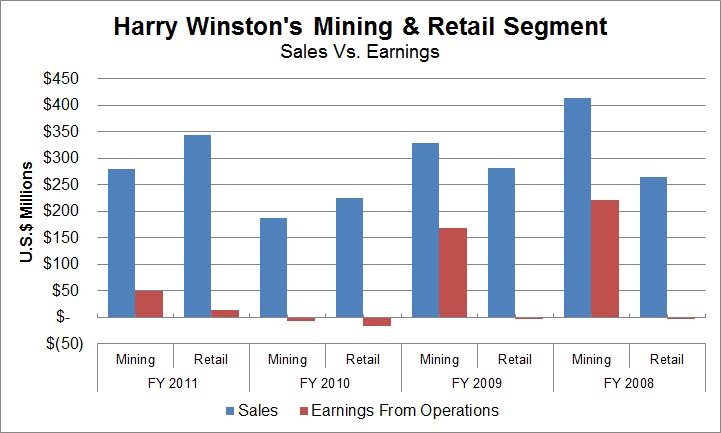

If the rule of thumb dictates that the greater the risk, the better the return, then Harry Winston Diamond Corp has been a case in point. The company’s mining segment has offered significantly better margins than its retail division, even as retail sales outpaced its rough sales (see graph below).

Based on data published by Harry Winston Diamond Corp.

And so, the iconic Harry Winston brand moves into the Swatch portfolio, where it will join other such prestige and luxury names as Breguet, Blancpain, Glashütte Original, Jaquet Droz, Léon Hatot, and Omega.

The move will enhance Swatch’s position as an important buyer of polished diamonds, particularly of better quality small stones. The Harry Winston deal will expand its purchases to other category, larger stones.

That’s not to say that polished suppliers will see a rush of demand from Swatch, even as the two companies see joint venture opportunities in sourcing polished diamonds for the brand under Swatch. Until Swatch has the business running smoothly, Dominion (currently Harry Winston Diamond Corp. until the deal closes) will continue to source polished from the market for Harry Winston/Swatch as it has for the brand up until now.

More significantly, Dominion and Swatch have begun discussing a possible joint venture in diamond manufacturing. While it may start as a small business, there is potential for growth. This column has noted in the past the growing influence of major jewelry retailers in the rough market (see editorials ‘Retail Diamantaires’ and ‘Between Rough and Retail’). Certainly, the entrance of a company such as Swatch into diamond manufacturing has prospects akin to Tiffany & Co. or Chow Tai Fook’s respective rough divisions.

From Dominion’s perspective, the joint venture would help maintain its window into the polished diamond sector, providing it at least with referencing for its rough prices. The company already outsources manufacturing of some of its rough in India, sources informed Rapaport News.

But while such matching of expertise may look good on paper, the practical benefits may prove more challenging. Setting up a manufacturing operation is therefore unlikely to be a priority for either company at this point.

Dominion, for one, certainly has its work cut out in 2013 as it ploughs ahead with its ambition to be Canada’s top diamond miner.

It should be stressed that both Harry Winston’s Swatch and Ekati deals are pending regulatory approval, with this week’s Swatch agreement presenting fewer hurdles and expected to close around the first quarter.

Ekati is more complicated. At stake are BHP Billiton’s 80 percent share of the ‘core zone’ of Ekati, where the operating mine is located, and its 58.8 percent interest in the ‘buffer zone,’ which contains various prospecting and development opportunities. The deal is pending the right of first refusal from BHP Billiton’s minority interest partners in the Ekati assets, who have 60 days to elect to buy Billiton’s stake in Ekati on the same terms offered to Harry Winston. An announcement is expected shortly as the deadline for the 60-day decision period should have passed this week. Just before press time, Harry Winston reported that one of the minority partners, C. Fipke Holdings Ltd., is contesting the deal in court.

Des Kilalea, an analyst for RBC Capital Markets, notes that the buffer zone contains at least one of numerous kimberlite pipes that seem to be economical and worth developing while the Ekati and Diavik mines sustain the company in the meantime. Therefore, should BHP Billiton’s partners exercise their right to buy the buffer zone, it would be seen as a setback for Dominion.

For Dominion, the buffer zone is vital as the company looks to secure its long-term future as a rough supplier. Eventually it will need another mine. After all, the existing Ekati mine and the Diavik mine, in which Harry Winston Diamond Corp has a 40 percent stake, with the remaining 60 percent owned by Rio Tinto, both have relatively short remaining life spans of seven to 12 years respectively.

The good news for now is that Dominion has both the cash and access to credit to move forward. It may have other acquisitions in mind too, if not already in the works. This week, Gannicott told Bloomberg News that the company would likely take up its right of first refusal for Rio Tinto’s 60 percent share in Diavik, if offered.

The big question therefore is whether Rio Tinto is offering. Back in March 2012, the Australian miner announced it was reviewing its diamond business for a possible exit from the industry. Since then, the market has been filled with speculation whether Rio Tinto will sell its four individual mines separately; or as an integrated business; spin the business off through a public offering; or simply maintain ownership.

Any option is possible. However, selling the full business might provide the greatest value for Rio Tinto given the age of its two flagship operations, Argyle and Diavik. Rio Tinto also has strong diamond branding programs in place that encompass all its operations. But as time passes, and the assets’ respective values dwindle, Rio Tinto’s options will diminish.

Kilalea expects the value of Diavik has declined since Harry Winston gave its estimated value for the mine in August 2012. The company valued 100 percent of Diavik at $2.6 billion with a 12-year remaining life through 2023. Since then, Kilalea explains, nearly one-twelfth of its life has passed and diamond prices have softened, which would further diminish its value.

Rough prices have indeed dropped. Diavik prices fell about 18 percent between the August assessment and December’s average prices published this week by Harry Winston. At the higher value A-154 North pipe, the average price fell about 21 percent to $170 per carat. Clearly, Diavik’s sale price would likely be significantly less than the suggested $2.6 billion valuation, especially, as Kilalea points out, the market expects a discount in such deals involving public companies.

Regardless of the Ekati and Diavik developments, Dominion may look elsewhere for acquisitions. Canada is still relatively ripe pickings in the diamond mining and development world (see editorial, ‘Canadian Diamonds’ published November 23, 2012). Stornoway Diamonds’ Renard project comes to mind, as does other development potential around Diavik, outside the Rio Tinto-Harry Winston joint venture.

Irrespective of whether those secondary opportunities emerge in 2013, Dominion will be conscious of its new-found position in the market this year. How and to whom it sells its rough will matter as its supply grows and it emerges as a top four diamond producer.

At the very least management at Harry Winston Diamond Corp has a clear direction, putting its eggs back in one mining basket. Having bought the luxury business as Aber Diamond Corporation in 2004, they go back to their mining roots and send the brand back where it belongs, to a luxury retail environment.

It is often said in business that a company should stick to what it does best. At the end of the day, the people at Harry Winston Diamond Corp are miners who may have stretched the downstream model a bit too far. By coming full circle, they will be able to build an effectively streamlined business, claiming their dominion in the diamond market.

The writer can be contacted at avi@diamonds.net.

Follow Avi on Twitter: @AviKrawitz

This article is an excerpt from a market report that is sent to Rapaport members on a weekly basis. To subscribe, go to www.rapnet.com or contact your local Rapaport office.

Copyright © 2013 by Martin Rapaport. All rights reserved. Rapaport USA Inc., Suite 100 133 E. Warm Springs Rd., Las Vegas, Nevada, USA. +1.702.893.9400.

Disclaimer: This Editorial is provided solely for your personal reading pleasure. Nothing published by The Rapaport Group of Companies and contained in this report should be deemed to be considered personalized industry or market advice. Any investment or purchase decisions should only be made after obtaining expert advice. All opinions and estimates contained in this report constitute Rapaport`s considered judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Thank you for respecting our intellectual property rights.

|

|

|

|

|