|

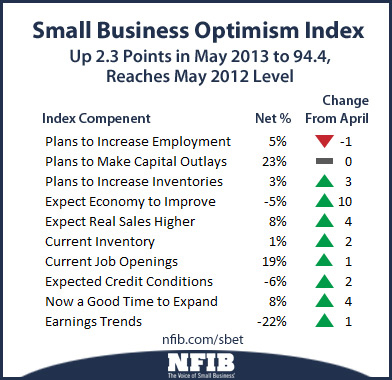

RAPAPORT... U.S. small business owner confidence improved to the level of one year ago, according to the June index of optimism as published by National Federation of Independent Business (NFIB). The latest index rose 2.3 points during May to 94.4 points, however, the NFIB cautioned that even though the reading was the second highest since the Great Recession started in December 2007, the index did not signal strong economic growth for small businesses. Eight of 10 index components gained momentum, showing some moderation in pessimism about the economy and future sales, but planned job creation fell one point and reported job creation stalled after five months of gains, according to NFIB. “Small-business confidence rising is always a good thing, but it’s tough to be excited by meager growth in an otherwise tepid economy,” said NFIB's chief economist Bill Dunkelberg. “Washington remains in a state of policy paralysis and while the stock market sets records, gross domestic product (GDP) posts mediocre growth. The unemployment rate remains in the mid-7s and it is departures from the labor force—not job creation—that is contributing to its decline when it does fall. It’s nice to see confidence not shrinking, but there isn’t much to hang your hat on in this report. We are back to where we were in May 2012. Two good months don’t make a trend, but we can’t have a trend without them, so it’s a start.” The small business sector of the GDP is not generating growth beyond population gains, the NFIB concluded. More businesses are being formed than lost, but too many existing firms have not yet started to replace the workers shed during the recession. The NFIB's Optimism Index is at its May 2012 level, which is identical to the November 2007 level. Since that time, however, the index has been higher in only three months, each time by less than two points. Small business owners cited taxes as their top problem (at 24 percent), followed by regulations and red tape (23 percent) and 16 percent claimed that weak sales were their biggest issue. Job creation in May fell for the first time since November 2012. The net percentage of owners expecting higher real sales volume rose four points to 8 percent of all owners. NFIB concluded that sales expectations are trending better, but are still historically weak. Access to credit continues to be a non-issue. Owners invested slightly more into capital expenditures in May; however, spending levels is still eight points below the average rate through 2007. Plans to increase expenditures stagnated, with 23 percent of owners planning capital outlays in the next three to six months. In May, a net negative 7 percent of all owners surveyed reported growth in inventory levels, one point below that reported in April. For all firms, a net 1 percent (up two points) reported stock too low, an unusually “lean” level of satisfaction with inventory. More owners are reducing stock than adding inventory, but the overall inventory picture was rather benign, according to the index.

|