|

|

Certified Polished Diamond Prices Stabilize in August

Diamond Cutters Face Liquidity Crunch

Sep 3, 2013 10:30 AM

By Rapaport

|

|

|

RAPAPORT... Press Release, September 3, 2013, New York: Certified polished diamond prices stabilized in August while dealers remained cautious amid low-volume trading. Cutting center liquidity is being squeezed by the devaluation of the Indian rupee, high rough prices and cautious bank lending. Diamond manufacturers are holding on to relatively large inventories ahead of the fourth quarter selling season, while retail jewelers are expected to delay their buying.

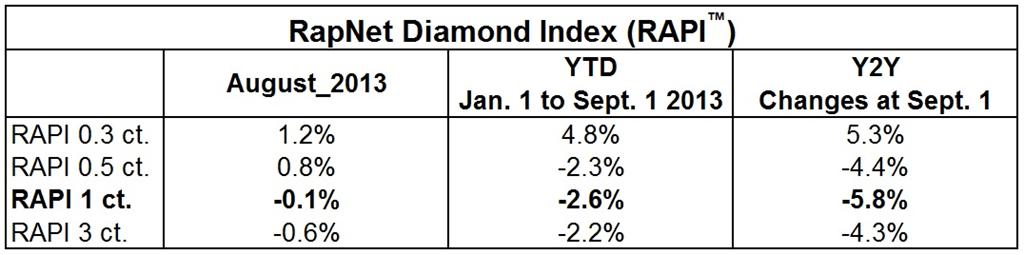

The RapNet Diamond Index (RAPI™) for 1-carat certified polished diamonds fell 0.1 percent in August. RAPI for 0.30-carat diamonds rose 1.2 percent during the month, while RAPI for 0.50-carat diamonds increased 0.8 percent. RAPI for 3-carat diamonds fell 0.6 percent.

The index is down from the beginning of the year after prices dropped in June and July. There is resilient demand for lower price points, with 0.30 to 0.40-carat, H-, VS-SI diamonds remaining the strongest category. RAPI for 0.30-carat diamonds increased by 4.8 percent in the first eight months of the year due to steady U.S. and Chinese demand for these goods.

Copyright © by Martin Rapaport.

According to the just released Rapaport Monthly Report – September 2013, “Liquidity Crunch,” the weak rupee continues to impact global diamond trading. There is rising expectation that India-based polished suppliers will reduce their prices at the September Hong Kong show in an effort to generate cash flow. India’s domestic market stalled as the rupee plummeted to a historic low of 69.22/$1, declining by more than 8 percent in August, while rupee-based gold prices hit a record high.

Chinese demand is selective with increasing demand for lower-quality diamonds at competitive price points and more buyers moving to memo. U.S. demand is stable with decent demand expected to continue during the fourth quarter.

Tight liquidity has forced manufacturers to refuse high-priced rough supply. Sightholders reportedly rejected 20 to 25 percent of approximately $600 million worth of rough on offer at the De Beers August sight. While De Beers reduced prices on cheaper Indian boxes, average prices were basically stable. There is very little activity on the secondary rough market with dealers giving long- term credit in order to offload goods.

“Rough prices are unsustainable because buyers will inevitably run out of money in the current market environment. Manufacturers should, and inevitably will, continue to refuse high-priced rough. Their inability to profit has resulted in less available credit and less liquidity. Miners are raising prices and rough is ahead of the polished. So why manufacture diamonds when it is so hard to make money? It's better to just buy polished,” said Martin Rapaport, Chairman of the Rapaport Group.

Read the attached Rapaport Research Report, “Liquidity Crunch,” at www.diamonds.net/report or email: specialreports@diamonds.net

Rapaport Media Contacts: media@diamonds.net U.S.: Sherri Hendricks +1-702-893-9400; International: Lisa Miller +1-702-425-9088; Mumbai: Manisha Mehta +91-97699-30065

About the Rapaport: RapNet Diamond Index (RAPI™): The RAPI is based on the average asking price in hundred $/ct. for the top 25 quality 1 ct. round diamonds (D-H, IF-VS2, RapSpec-2 and better) with GIA grading reports offered for sale on RapNet – Rapaport Diamond Trading Network. The RAPI is provided for various sizes. www.RAPNET.com has daily listings of over 1 million diamonds valued over US$6.7 billion and 12,000 members in over 85 countries.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added value services that support the development of fair, transparent, efficient, and competitive diamond and jewelry markets. Established in 1978, the Rapaport Diamond Report is the primary source of diamond price and market information. Group activities include Rapaport Information Services providing research, analysis and news; RapNet – the world's largest diamond trading network; Rapaport Laboratory Services provides GIA and gemological services in India, Belgium and Israel; and Rapaport Trading and Auction Services with monthly sales of over 50,000 carats. The Group employs 180 people with offices in New York, Las Vegas, Antwerp, Ramat Gan, Mumbai, Surat, Dubai, Hong Kong and Shanghai. Additional information is available at www.Rapaport.com.

Martin Rapaport (Publisher) grants limited permission to use copyrighted data appearing in this press release in and in conjunction with journalistic copy, reporting or articles concerning diamond pricing and information in graph or data presentation format only. The following credit notice must appear alongside, underneath, or in close proximity to any use of the copyrighted data: “Used with permission of Rapaport USA, Inc. Copyright © Martin Rapaport. All rights reserved.”

|

|

|

|

|

|

|

|

|

|

Tags:

diamonds, Rapaport, RAPI, RapNet Diamond Index

|

|

|

|

|

|

|

|

|

|

|

|

|