|

|

Embracing Technology

A Conversation with Uzi Levami

Nov 28, 2013 9:46 AM

By Avi Krawitz

|

|

|

RAPAPORT... Sarin Technologies tends to view the diamond industry from a different angle given its position in the market. As one of the largest suppliers of technology and equipment used by the diamond manufacturing sector, the company has had to adapt to the volatile market environment and has arguably leveraged the challenging new industry reality to its benefit.

If anything, Uzi Levami, Sarin’s chief executive officer (CEO), noted that manufacturers have become more reliant on technology as they have less room for error than before, due to the tight margins inherent in diamond cutting.

“The ability of a manufacturer to look at a rough diamond and understand what type of polished he can create in the most efficient way is a huge advantage, and it’s become even more important since the 2008 crisis,” Levami (pictured) explained to Rapaport News. “Before the downturn, credit was abundant and polished prices rose consistently, so the cost of an error [in manufacturing] wasn’t so great. Today, cutters don’t have that luxury and they don’t know how the market will evolve. So their ability to understand what to do with each stone is critical to their survival.”

Especially for mass polished diamond producing centers as India, he stressed that manufacturers have embraced technology as a means to drive efficiencies, gain better insight into their operations and improve their flexibility.

Third-Quarter Growth

It’s not surprising then that Sarin’s financial performance tends to mirror trends in the manufacturing sector. The company accrues about 76 percent of its revenue from India, given the country’s dominance in the diamond manufacturing space. Southern Africa is its second-largest market, accounting for approximately 6 percent of revenues in 2013, followed by Israel with 5 percent, Europe with 2.5 percent and North America with 1 percent.

While the fourth quarter is usually the company’s weakest period of the year – largely due to the Diwali break when many Indian factories close in November – Sarin noted a particularly tough environment in the recent third quarter, resulting from the weak rupee, tighter credit from the Indian banks and a squeeze on margins due to high rough prices.

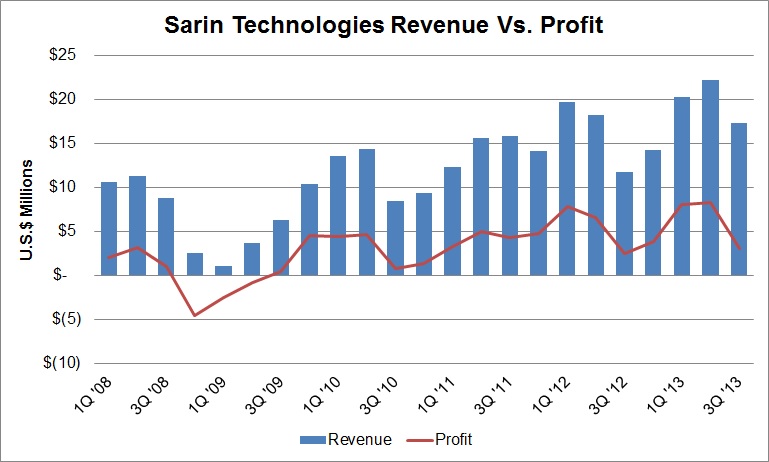

Still, the company managed to post relatively strong year-on-year third-quarter growth, partly due to an even weaker environment in the same period of 2012. Revenue increased 48 percent year on year to $17.3 million while profit grew 22 percent to $3.1 million. Levami declined to offer an outlook for the ongoing fourth quarter, only to say that manufacturers have returned from the Diwali break with guarded optimism but willing to buy rough and to spend on equipment.

Rapaport News Rapaport News

Recurring Revenue

Given the cyclical nature of the industry, Sarin has historically enjoyed stronger performance in the first half of the year than the second, and it has managed to maintain steady annual growth since the 2008-09 downturn.

Levami noted that the crisis forced Sarin to rethink its strategy with many of its current catalysts for growth emerging from the discussion that took place during the downturn – including its focus on the Galaxy products and its switch toward a recurring revenue model.

“We had to decide what products to focus on and find the right balance between technologies in our portfolio,” he explained. “In 2009 we had the new Galaxy technology but the market situation was such that charging the full price would limit the number of manufacturers who would have access to it. So we opted for a pay-as-you-go type of revenue model.”

As a result, the Galaxy products, which are used to map the inclusions in rough diamonds, are available for usage on a stone-by-stone basis either at Sarin’s various service centers or at a manufacturer’s factory site. A company which opts to have the machine installed at its facility is charged on a per-carat basis for rough larger than 2.5 carats, or a monthly fee for smaller goods.

The company reported that its recurring revenue rose 50 percent in the third quarter, accounting for about 30 percent of total revenue in the first nine months of the year, mainly from the 127 Galaxy systems that were in the market until then. Levami expects that proportion to rise as the company hopes to roll out an anticipated 10 Galaxy machines per quarter – it installed just five in the third quarter – and as it adopts a similar model to other products that mainly target the polished market.

Sarin is also focusing on the retail market to spur growth with the introduction of the Sarin Light, which allows consumers to compare similar diamonds; and the Sarin Loupe, which is an imaging system that enables buyers to view a diamond online from a remote location, allowing them to participate in the development process of the stone.

Demand-Driven Products

While these high volume, lower cost products may diversify Sarin’s revenue base, Levami noted that they also demonstrate how technology can be used to provide added value to retailers and spur consumer confidence in diamonds.

In fact, he pointed to technology as a means to tackling many of the challenges facing the industry today. Among these, Levami stressed that finding a solution to the issue of undisclosed synthetic diamonds being mixed with natural diamonds will require industry-wide cooperation to make the technology more cost effective for smaller stones. He added that Sarin has opted not to bring a product to market as De Beers and the Gemological Institute of America (GIA) have done.

“We understood very early that if the bigger players would partner to find a solution, the issue would be resolved,” he said. “I believe the industry is better served by others in the market and we will intervene only if there is a more targeted and specific need.”

Levami noted that while the company has numerous technologies available to tackle issues in the industry, the decision to develop a product depends on market demand. For now, therefore, he recognized that Sarin’s strongest growth opportunity lies in enabling manufacturers to improve their operating efficiencies in an ever-changing environment.

“In the past, manufacturing wasn’t so connected to market trends. [Diamond cutters] would manufacture and the goods would trickle down to wholesalers, merchants and retailers,” he explained. “Today, it’s different. Manufacturers are more aware of consumer trends and market developments, and they impact their everyday decisions on what rough to buy and which goods to process. The supply chain works much more efficiently than it did in 2007, and technology is playing an increasingly important role in the process.”

The writer can be contacted at avi@diamonds.net.

Follow Avi on Twitter: @AviKrawitz

This article is an excerpt from a market report that is sent to Rapaport members on a weekly basis. To subscribe, go to www.diamonds.net/weeklyreport/ or contact your local Rapaport office.

Copyright © 2013 by Martin Rapaport. All rights reserved. Rapaport USA Inc., Suite 100 133 E. Warm Springs Rd., Las Vegas, Nevada, USA. +1.702.893.9400.

Disclaimer: This Editorial is provided solely for your personal reading pleasure. Nothing published by The Rapaport Group of Companies and contained in this report should be deemed to be considered personalized industry or market advice. Any investment or purchase decisions should only be made after obtaining expert advice. All opinions and estimates contained in this report constitute Rapaport`s considered judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Thank you for respecting our intellectual property rights.

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, diamonds, Rapaport, Sarin Technologies, Uzi Levami

|

|

|

|

|

|

|

|

|

|

|

|

|