|

RAPAPORT... Ecommerce sales growth rates for Macy's, Walmart and Costco surpassed Amazon's in the first quarter of the year because those brick-and-mortar retailers continue to invest and perfect their omnichannel strategy across the organization, according to L2 Think Tank. L2 tracked 100 retailers for its annual omnichannel retail study and included jewelers Alex and Ani, Cartier, Fossil, Montblanc, Swarovski, Swatch, Tag Heuer, Tiffany & Co. and Tourneau. Larger retailers that sell jewelry included Barneys, Bloomingdales, Chanel, Gucci, Macy's, Michael Kors, Neiman Marcus, Nordstrom, Saks, Sears, Target and Walmart. Of the luxury product category, only Gucci and Tourneau offered real-time in store product visibility online, whereas 75 percent of the department stores (except Barneys and Bergdorf Goodman) had integrated their store inventory with the digital channel.

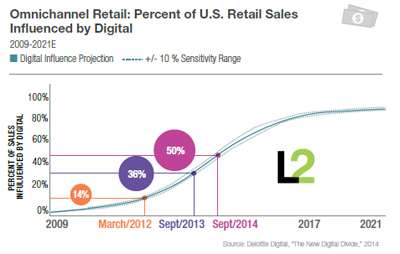

However, L2 found that 44 percent of luxury goods purchases in the past year were made in stores after shoppers were first influenced by what they found online. Only 4 percent of luxury goods were purchased through ecommerce. Jewelers that have not developed their omnichannel strategy and, thus, haven't placed their store inventory across the digital channel are missing a great sales opportunity, according to the group. Digital influence for all product purchases is growing exponentially and L2 predicted that by this September in the U.S., more than half of all offline retail sales will have been influenced by the digital experience.

Which retailers are "role models" for the omnichannel experience? L2 said, Saks, Guess, Walgreens and Walmart meet the challenge, with Coach, Gap, Neiman Marcus and Sephora narrowly missing out. These retail models balance online and offline investment, focus on consistency across all channels, offer strong mobile apps, consumer loyalty programs and facilitate dynamic data capture for example. However, L2 noted that the luxury brands have a lot of catching up to do, as the jewelry and watch category scored lowest overall for integrating the digital and in store experience. L2 stated that to create (or improve) a strong omnichannel strategy, at least include all of the following capabilities: online purchase and in store pickup, real-time in store inventory, enable product filtering and store locator, personalized store promotions and booking appointments, shopper wishlists, allow preorders, offer exclusives as well as free shipping and expedited delivery. L2 also observed reasons why the omnichannel strategy may fail certain retailers, with the greatest barrier being the company's own business model. Other challenges included difficulty integrating backend systems with new technology designs and the inability to sharing customer data across all platforms. Human problems included team conflicts, limited associate training and departments that can't break out of the silo mentality.

|