|

|

De Beers Value Proposition

Editorial

Nov 6, 2014 11:38 PM

By Avi Krawitz

|

|

|

RAPAPORT... The analyst presentation that De Beers published this week on behalf of Anglo American was as revealing as the company’s much publicized Diamond Insight Report. Whether this was a once-off publication or not, the presentation was another step that De Beers took to open up to the industry and investors alike.

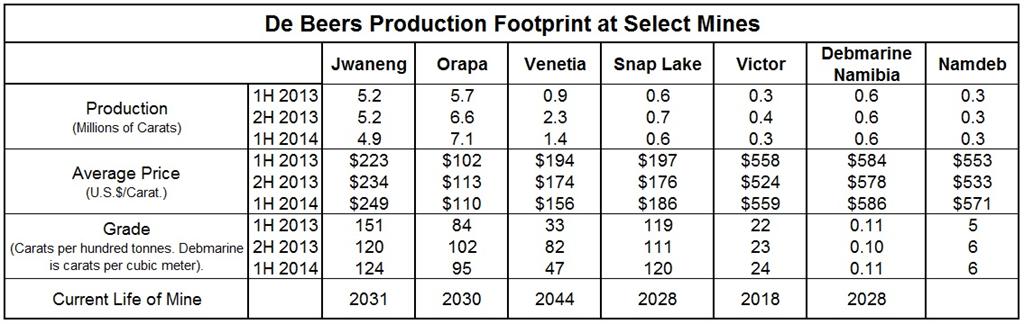

For the first time, De Beers provided detailed data about its core mining operations, including reserves, life-of-mine, ore grades and price per carat of production at select mines. The company also revealed some insights into its performance this year that was not previously published.

As part of the Anglo American group, De Beers adheres to the requirements of its parent company in its interim and annual reports. That has resulted in less information being divulged than before when De Beers was controlled by the Oppenheimers.

In a presentation plus question and answer session that lasted two-and-a-half hours, De Beers management outlined the nature of its operations both at the mining and downstream level, its position in the market, how it approaches seasonality of diamond and jewelry demand, key trends in the diamond industry and how it is positioned in that context, along with its complicated structure and accounting methods.

What has emerged is a company focused on driving its value proposition for Anglo American. As such, the presentation was designed to accent Anglo’s value proposal to investors. There’s simply no other reason for De Beers to reveal such sensitive data.

ROC(E) Solid

Not only does the future look bright for Anglo’s diamond division, but so does the present. Analysts continue to view De Beers as the best asset in Anglo’s portfolio, particularly as commodity prices have dropped this year. Anglo’s other key divisions include iron ore, coal, platinum, and copper.

As Anglo’s star performer in the first half of 2014, De Beers accounted for 26 percent of Anglo’s underlying operating profit, up from 18 percent a year earlier, while its share of group revenue rose to 24 percent from 21 percent in the first half of 2013. Perhaps most importantly, De Beers return on capital employed (ROCE), a measure of efficiency that Mark Cutifani, Anglo’s CEO, is bent on scrutinizing, improved from 8 percent to 13 percent. That far outpaced the overall Anglo average, which fell slightly to 10 percent.

De Beers management reiterated its pledge to achieve Cutifani’s ROCE target of 15 percent by 2016. The presentation was largely geared toward relaying that message.

What’s New?

Here’s what we learned about De Beers performance in the first half of 2014 that we didn’t know before: the company sold 19 million carats of diamonds during the period, including about 900,000 carats of Debswana’s supply to Okavango Diamond Company in Botswana. While production stood at 16 million carats, management explained that it takes four to five months for production to move from mine to sightholders, meaning that much of the sales volume in the first half of this year stemmed from production in the latter half of 2013.

De Beers price index rose 7 percent during the half year, while its actual realized prices fell 3 percent from the 2013 average to $192 per carat. The decline resulted from the company selling more small goods to Indian manufacturers, who had reduced their buying a year earlier when the rupee depreciated.

Management was less forthcoming when asked about price trends in the second half of the year. While they noted a decline in “some polished diamond indices,” the company reported a marginal drop in its rough prices. Management qualified that De Beers long-term contracts tend to outperform spot prices in a downward trending market.

Initial reports from this week’s De Beers sight suggested that prices were basically unchanged. Therefore, while rough prices have corrected on the secondary market, and by some projections are now flat for the year, De Beers has maintained price inflation of an estimated 5 percent in 2014. Coupled with steady production from the first half, Rapaport conservatively estimates that the company is on track to achieve rough sales of around $6.5 billion for the year, which would be 11 percent above 2013 levels and about in line with its 2011 bumper year.

De Beers has said in the past that it will make minor adjustments to its prices on a sight-by-sight basis, but that the general trend will be upward given its rising costs. The company explained that its biggest cost has been its purchase of diamonds from its mining joint ventures. De Beers diamond purchases rose 12 percent to $1.9 billion in the first half, while its production cost grew 17 percent to around $700 million. The company did not give a cost structure on a mine-by-mine basis due to contractual constraints with its government partners in Botswana and Namibia.

Driving Volume

The key takeaway from the presentation was that while Anglo has imprinted a strong focus on improving efficiencies, growth at De Beers will be driven by long-term price inflation and full volume of sales.

Today, we have a better understanding of what that means. The presentation did not give a total account of De Beers resources, but it did disclose the reserves and resources held from select mines that represented the vast majority of production – although the projections did not account for future expansion potential.

Based on current production activity, the Venetia operation in South Africa holds the longest life of mine in the portfolio with the underground construction that began earlier this year set to extend operations to around 2045. Similarly, the Cut-8 project currently in progress at the Jwaneng mine in Botswana will extend mining to 2031, although a likely investment in a Cut-9 and Cut-10 expansion, and an eventual shift to underground mining would see Jwaneng yielding diamonds at least until 2050.

In its own language, Jwaneng is the “jewel” of the De Beers portfolio, and it is little wonder that the company is so invested in prolonging its life. Considered the world’s richest mine by value, Jwaneng yielded an average price of $229 per carat in the first half of 2014, with a grade of 124 carats per hundred tonnes of ore mined. In comparison, Orapa garnered $110 per carat and a grade of 95 carats per hundred tonnes, while Venetia had an average price of $156 per carat and a grade of 47 carats per hundred tonnes. The Victor mine in Canada had a high price per carat but low grade and volume, as did the company’s Namibia operations.

De Beers maintained its forecast of 32 million carats this year and projected production to rise to 34 million carats in 2015. Annual production is likely to peak at around 36 million carats before starting to decline from 2020. Long-term production will be sustained primarily by Jwaneng, Venetia and Orapa, but also by the Gahcho Kué mine being developed in Canada, in which De Beers holds a 51 percent stake, which is expected to launch production in late 2016. The Victor mine in Canada is expected to be depleted around 2018, while the Snap Lake mine might prove too complex to warrant long-term investment.

Beyond that, the company maintains an exploration budget of about $50 million a year but has very few prospective projects on the immediate horizon. Angola remains its most encouraging area, while the company also holds exploration licenses in Canada, India, South Africa and Botswana.

Rather, the company is focused on developing its current projects and has invested close to $3 billion in Venetia, Jwaneng and Gacho Kué to ensure long term production. Some expect De Beers to eventually buy the 49 percent stake of Gacho Kué held by Mountain Province as a means to beef up overall volume.

Going Downstream

Management then walked analysts through De Beers downstream operations with CEO Philippe Mellier rather sheepishly admitting that De Beers Diamond Jewellery, its retail joint venture with LVMH, was more about gaining knowledge about the high-end jewelry sector than driving profit. The company has also set an annual marketing budget of $100 million to promote the Forevermark diamond brand, which has now reached some 1,500 stores, but also remains more of a branding exercise to drive demand than a significant profit-making exercise.

After all, De Beers at its core remains a diamond mining company whose bottom line is driven by production volume and price. Mellier stressed that much of the company’s downstream activities, including its branding efforts and intelligence gathering, is focused on generating demand that would support its own growth platform. As Cutifani recognized, that sets De Beers apart from Anglo’s other subsidiaries.

“Diamonds are not a commodity,” Cutifani said. “Our involvement with De Beers does give us a unique perspective in terms of markets and an extra string in our bow. We think carefully about the market and our positioning in the market, and we think very carefully about volume, quality, price and the tradeoffs therein to ensure that we’re delivering value for the long term.”

Certainly, De Beers believes that it has struck the right balance between volume and price to enhance its position in the diamond market. Perhaps to justify that, the company also appears increasingly willing to disclose its own intelligence, and previously sensitive information, to drive value for its majority shareholder, and hopefully, Anglo’s investors alike.

The writer can be contacted at avi@diamonds.net.

Follow Avi on Twitter: @AviKrawitz and on LinkedIn.

This article is an excerpt from a market report that is sent to Rapaport members on a weekly basis. To subscribe, go to www.diamonds.net/weeklyreport/ or contact your local Rapaport office.

Copyright © 2014 by Martin Rapaport. All rights reserved. Rapaport USA Inc., Suite 100 133 E. Warm Springs Rd., Las Vegas, Nevada, USA. +1.702.893.9400.

Disclaimer: This Editorial is provided solely for your personal reading pleasure. Nothing published by The Rapaport Group of Companies and contained in this report should be deemed to be considered personalized industry or market advice. Any investment or purchase decisions should only be made after obtaining expert advice. All opinions and estimates contained in this report constitute Rapaport`s considered judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Thank you for respecting our intellectual property rights.

|

|

|

|

|

|

|

|

|

|

Tags:

A, Anglo American, Avi Krawitz, De Beers, diamonds, Forevermark, Jewelry, Mark Cutifani, Rapaport

|

|

|

|

|

|

|

|

|

|

|

|

|