|

|

Global Diamond Jewelry Demand +3% in 2014

Mar 20, 2015 8:00 AM

By Avi Krawitz

|

|

|

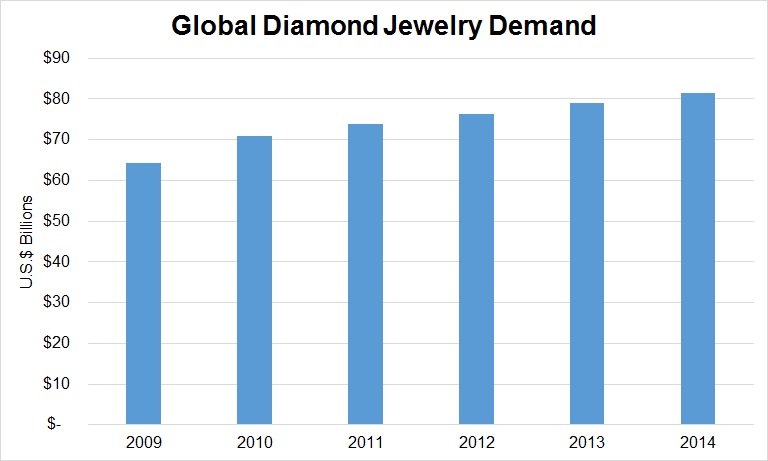

RAPAPORT... Global diamond jewelry demand rose 2.9 percent year on year to $81.4 billion in 2014, according to industry insight data published by De Beers on Friday. The research sets a new high for global demand, but also represents the slowest growth in dollar terms since 2009 (see Figure 1).

“We saw continued growth in consumer spending on diamond jewelry, which was a pretty good result considering the fragile world economy,” Stephen Lussier, De Beers executive vice president of marketing, told Rapaport News. “The other positive is that retailers across all key diamond jewelry markets are optimistic they will continue to see that level of growth in 2015.”

Figure 1 Based on data published by De Beers.

The company noted that optimism is highest in the U.S. and India, while growth in China is expected to improve as the year progresses beyond the first quarter of 2015.

However, in 2014, the De Beers research showed that the pace of growth slowed due largely to a deceleration in China, India and Japan. The U.S. was a bright spot as demand was driven by the economic recovery, growing job numbers and an improving stock market, while declining oil prices further increased consumers’ spending power, the company added.

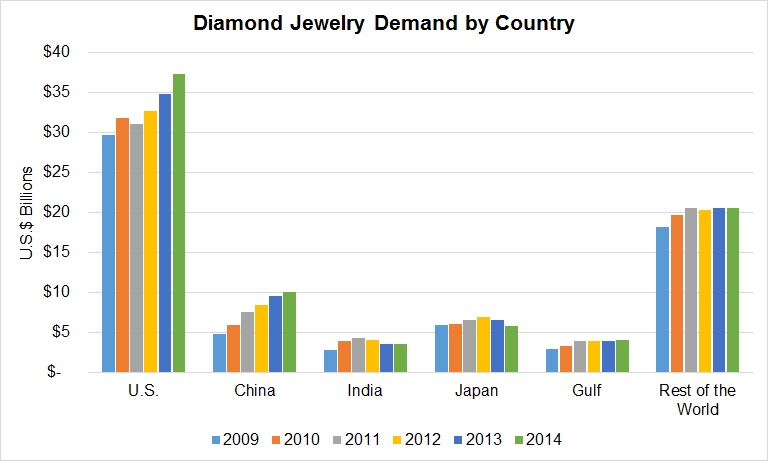

De Beers revealed the following findings for 2014 from its research:

• U.S. diamond jewelry demand increased 7.2 percent to $37.3 billion.

• Demand in China grew 5.2 percent to $10.1 billion.

• Demand in India was flat at $3.6 billion.

• Japan’s diamond jewelry demand fell 12.1 percent to $5.8 billion.

• Demand in the Gulf grew 2.5 percent to $4.1 billion.

• In the rest of the world, demand was flat at $20.5 billion.

Japan and India were affected by weak currencies against the U.S. dollar. At constant-exchange-rates, global demand increased by 5 percent, with growth recorded in local currency terms across all major markets, De Beers reported.

U.S. Demand

Still, the market was buoyed by a strong showing in the U.S.

While Lussier acknowledged that middle-income households in the U.S. continue to be frugal, he reported that the overall market was lifted by strength in the bridal sector and among affluent consumers who earn more than $150,000 a year.

“The U.S. market is a bit narrower than it was before the 2008 crisis, but those two segments have been pretty healthy,” he said. “Bridal, which accounts for about 30 percent of U.S. sales, has provided a strong foundation for growth that other competitive products don’t have.”

Lussier reported that U.S. demand remains centered on SI-clarity diamonds, even among the higher-income earners who tend to scale up in size rather than quality.

China Slows

In contrast, Lussier suggested that China remains focused on better-quality VVS-VS-clarity diamonds, although he stressed that China is a much more segmented market. Demand for better-quality VVS-VS clarity diamonds stems more from the tier I and tier II cities, which tend to have higher-income earners, he explained.

However, growth in China is being driven by expansion into tier III and tier IV cities where income levels and price points tend to be lower, influencing growth in demand for VS-SI diamonds. “As the Tier III and Tier IV cities become more important in terms of market share, it does pull down the average price slightly and results in the expansion of those medium-quality diamonds,” he explained.

De Beers reported that the slower pace of diamond jewelry sales in China was caused due to a slowdown in economic growth, which had a wider impact on the tier I and tier II cities, while political protests in Hong Kong also affected overall sales. Demand among Chinese tourist shoppers abroad compensated for some of the domestic slowdown, the company added.

Main Markets

Therefore, global demand continues to be driven by the U.S. and China, which have shown consistent growth since the 2008-09 downturn. Demand in other markets has been relatively stable in the past six years (see Figure 2).

Figure 2 Based on data published by De Beers.

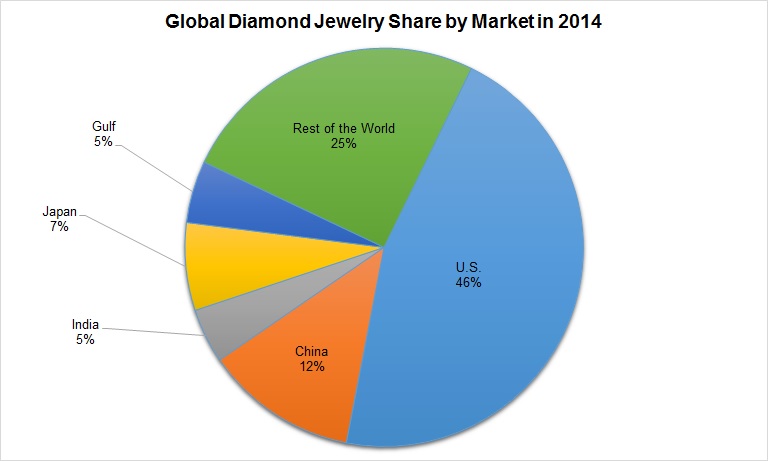

Given its above average growth, the U.S. increased its market share to account for 46 percent of global demand in 2014, compared with 44 percent the previous year. China maintained its 12 percent share of the market, while Japan dropped off slightly with 7 percent (see Figure 3).

Figure 3 Based on data published by De Beers.

4Q Slowdown

De Beers noted some softness in the U.S., China and Japan during the fourth quarter. China and Japan were impacted by weaker macroeconomic trends, while in the U.S., the research suggested that there was a trend toward less last-minute Christmas gift shopping, driven by early promotional activity.

Lussier suggested that this trend affected all retail products in the U.S., and not just diamonds and jewelry. Still, while consumers shifted to spending earlier in the season, sales were slightly below expectations, leaving jewelry retailers with slightly larger inventory levels at the beginning of 2015.

Regardless of the season, U.S. independent jewelry retailers are managing with lower inventory levels. They have had to focus on holding the right type of inventory as they have wrestled with lower margins since the 2008 downturn, Lussier explained.

However, he added that at the start of 2015, there was a slight overhang of inventory that has affected liquidity in the midstream diamond market, among other trade-specific factors.

Retail Optimism

It appears that the industry over-bought earlier in the year and, ultimately, demand failed to meet those expectations expressed in the first half of 2014.

Lussier was confident that the extra inventory evident in the market after the season was not substantial and will be diminished fairly quickly.

Indeed, De Beers stressed that retailers expressed optimism in all markets for 2015, even if there is a slight disconnect between activity within the trade and the retail market.

“Retailers are more consistent and they’re optimistic for the year,” Lussier said. “The main message to everyone is to reflect that the foundation of our business is based on consumer demand, which continues to grow. If we can maintain that growth, it will provide an opportunity for all the other issues to work their way through.”

“Consumers spent more on diamond jewelry in 2014 than they did in 2013 and they expect to spend more in 2015. That provides a framework for all of us to be successful,” he added.

The writer can be contacted at avi@diamonds.net.

Follow Avi on Twitter: @AviKrawitz and on LinkedIn.

This article is an excerpt from a market report that is sent to Rapaport members on a weekly basis. To subscribe, go to www.diamonds.net/weeklyreport/ or contact your local Rapaport office.

Copyright © 2015 by Martin Rapaport. All rights reserved. Rapaport USA Inc., Suite 100 133 E. Warm Springs Rd., Las Vegas, Nevada, USA. +1.702.893.9400.

Disclaimer: This Editorial is provided solely for your personal reading pleasure. Nothing published by The Rapaport Group of Companies and contained in this report should be deemed to be considered personalized industry or market advice. Any investment or purchase decisions should only be made after obtaining expert advice. All opinions and estimates contained in this report constitute Rapaport`s considered judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Thank you for respecting our intellectual property rights.

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, China, De Beers, diamond jewelry, diamonds, jewellery, Jewelry, Rapaport, Stephen Lussier

|

|

|

|

|

|

|

|

|

|

|

|

|