|

|

Higher Interest Rates, Lower Jewelry Spending?

Insights

Dec 10, 2015 9:42 AM

By Avi Krawitz

|

|

|

RAPAPORT... What can the diamond industry expect when the Federal Reserve raises interest rates for the first time in seven years? Or, more pointedly, will a rate hike put a dent in discretionary spending? With the Fed widely expected to increase rates next week, diamantaires ought to consider if external economic factors will exacerbate a crisis largely stemming from industry-specific issues by putting consumer demand for diamonds under pressure.

At a Congressional hearing last week, Fed Chairwoman Janet Yellen appeared confident the economy can withstand the first step toward interest-rate normalization as steady growth is being sustained and inflation is likely to pull back toward its 2 percent target level. “The U.S. economy has recovered substantially since the Great Recession,” she said.

Yellen noted real gross domestic product (GDP) has risen at a moderate pace as the labor market improved, while private purchases – household spending, business fixed investment and residential investment – have outpaced real GDP growth this year.

“Job growth has bolstered household income, and lower energy prices have left consumers with more to spend,” Yellen said at the hearing on December 3. “Increases in home values and stock-market prices in recent years, along with reductions in debt, have pushed up the net worth of households, which also supports consumer spending.” Her position was vindicated the next day when the Labor Department reported employers added 211,000 jobs in November, beating analyst expectations in market surveys.

Yellen disagreed with Congresses’ concern that a slower wage growth, stronger dollar and the recent terror attacks in the U.S. would destabilize the economic recovery suggesting that a continuation of the Fed’s easy monetary policy is appropriate. As expected, her hawkish comments fueled long-standing speculation the Fed will raise rates at its next policy meeting on December 15-16.

Measured Approach

For many, the Fed fund rate has been left too low for too long and a change in trajectory is inevitable. Importantly, the U.S. central bank is expected to adopt a measured approach as analysts at Nomura Global Markets Research forecast a second increase in rates is unlikely before June. It seems the Fed wants to allow initial 2016 economic data to sink in before deciding on further hikes as a policy reversal after starting the normalization process would greatly undermine its credibility. The initial rate increase will probably be small, with some saying it could be as low as 10 basis points, as the Fed would like to err on the side of caution.

Regardless, the diamond and jewelry companies should take it as a message to stay on a conservative path. At least, being over-financed at this stage of the interest-rate cycle would not be considered prudent. As banks cut lending to the industry in 2014/15, excessive borrowing – at least in the West – is probably not a major concern.

In an interview with Rapaport News in May, Eric Jens, chief executive officer of ABN Amro’s Diamond & Jewellery Clients, said diamantaires will take measured decisions when rates go up in the same way as they did when credit lines were cut short (see “Market Correction,” by Martin Rapaport, chairman of the Rapaport Group).

“They will make calculations with higher rates and decide to either leave goods on the table, slow down operations or find a different way of financing,” he said. “That’s a normal function of the market that becomes more difficult to navigate as interest rates go up and volatility rises.”

Demand Side Challenges

Their bigger worry will, however, be consumer demand. A rate hike will leave households with fewer dollars to spend because of a rise in installments for mortgages and other loans. A multiplier effect occurs as businesses face a double-whammy of lower sales from a cut-back in consumer spending and higher cost of debt servicing, both of which weigh on the valuation of their shares and stock-market prices.

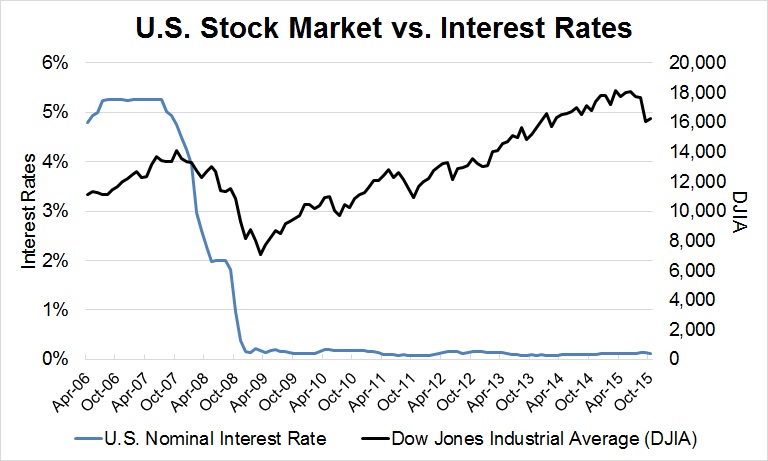

The converse was true when share prices touched dizzy heights after interest rates dropped to near zero in early 2009 (see graph). Investors gravitated toward stocks because savings deposits in banks yielded precious little. Stock market valuations will start to look pricey as rates start to rise, and since the banks will offer an alternative by giving some return at higher rates a correction may be on the cards. And that would jolt investor – and industry – confidence as a perceived reduction in household wealth puts additional pressure on spending.

Rapaport Research

Higher interest rates will also further strengthen the dollar, which is already trading above its long-term average as demand for the greenback will increase. Demand for the local currency generally rises when interest rates rise because investors assume that if they invest their capital in the currency, they will receive a higher interest return.

A stronger dollar will have a negative impact on translated earnings of multinationals, and the deflationary effect is evident in jewelry sales denominated in yen, euro, rupee or even yuan renminbi. In 2015, De Beers said the greenback’s strength and a slowdown in China curbed global growth.

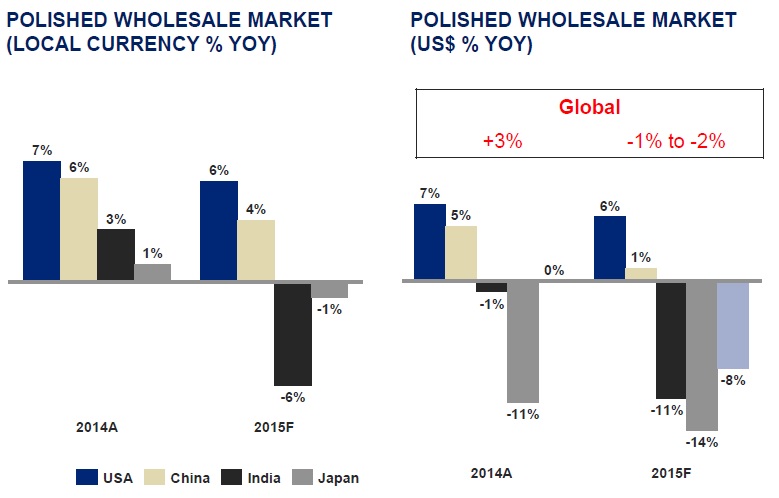

Global polished wholesale demand contracted 1 to 2 percent during the year, but when measured in local currency terms it edged up, De Beers estimated in an investor presentation on Tuesday. The U.S. market grew about 6 percent, while China climbed 4 percent in yuan but just 1 percent in dollar terms. Sales in India fell 6 percent in rupees and slumped 11 percent in dollars, while in Japan the market contracted 1 percent in yen and by 14 percent in dollars in 2015, De Beers estimated (see graph).

Source of graph: De Beers.

Considering a rate hike in isolation, U.S. consumers might be spending on tighter budgets in 2016 while the impact of the strong dollar on other markets might be just as severe as in 2015, if not more so. Then again, there are many other factors at play and the industry should be encouraged by Yellen’s optimistic outlook for the U.S. economy. Furthermore, as the Fed is expected to move at a measured pace, the impact is unlikely to be too dramatic or immediate.

Still, the trade ought to take note as it is currently focused on industry-specific challenges to reduce inventory and raise manufacturing profitability. It might consider that its prospects for 2016 will also be influenced by external economic factors, making initiatives to raise consumer demand even more pressing. After seven years of cheap money, a Fed funds rate rise expected next week will test not only the economy’s resilience but also the health of the diamond industry beyond its internal challenges.

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, De Beers, diamonds, Fed, Federal Reserve, Interest Rates, Janet Yellen, Jewelry, Rapaport

|

|

|

|

|

|

|

|

|

|

|

|

|