|

|

Landmark Ruling Forces Rough Diamond Refund

Dec 20, 2016 4:08 AM

By Avi Krawitz

|

|

|

RAPAPORT... The Israel Diamond Exchange (IDE) ordered a dealer to cancel the sale of a rough diamond after he failed to comply with new guidelines requiring sellers to disclose if a stone has undergone value analysis using a Sarine Galaxy machine.

The arbitration is the first of its kind, sources familiar with the case told Rapaport News. It comes after the World Federation of Diamond Bourses (WFDB) adopted new rules in May aiming to keep a level playing field between both parties trading rough diamonds.

According to the WFDB bylaws, sellers must inform buyers if a rough diamond has undergone inspection using the Galaxy machine, or any similar system that indicates the stone’s value. Failure to do so could annul the transaction and the seller could be subject to further claims.

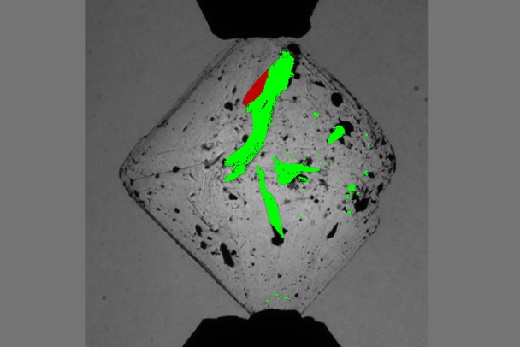

The Galaxy system maps inclusions in a rough diamond, enabling a good assessment of the stone’s value as well as the potential polished diamond, explained David Block, Sarine’s chief operating officer.

Disclosure is required when using the Galaxy 2000 model, which scans the diamond but without physically marking where the inclusions are, thus leaving no record of the analysis on the stone. Marking is part of the process with the Galaxy 1000 system, which is predominantly used by manufacturers.

The IDE found the rough supplier failed to disclose his use of the Galaxy 2000, putting the buyer at a disadvantage, the source explained. Once it was proven the stone had undergone screening, the seller was ordered to reclaim ownership and provide a full refund for the diamond, the source added.

Sarine entered into an agreement with IDE stating that, when requested, it would confirm whether or not a diamond has undergone screening, but without disclosing the details of the analysis. Block said a number of such requests have been made this year.

IDE declined to comment on the arbitration case. However, the exchange acknowledged efforts to bring about full disclosure when dealers use the Galaxy machines, after the WFDB adopted the proposal that was initially put forward by IDE.

“Full disclosure and transparency is of utmost importance to us,” said Yoram Dvash, president of IDE. “The WFDB decision especially benefits the smaller manufacturers who form the base of Israel’s manufacturing pyramid.”

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, diamonds, Israel Diamond Exchange, Rapaport, rough, Sarine

|

|

|

|

|

|

|

|

|

|

|

|

|