|

|

Polished Prices Slide Despite Buoyant Rough Market

Feb 1, 2017 2:04 AM

By Rapaport

|

|

|

RAPAPORT... PRESS RELEASE, February 1, 2017, New York… Diamond manufacturing profits were squeezed in January amid strong rough demand while polished prices softened. Polished trading was cautious after disappointing U.S. holiday jewelry sales, while the rough market was driven by expectations jewelers will replenish inventory sold during the season.

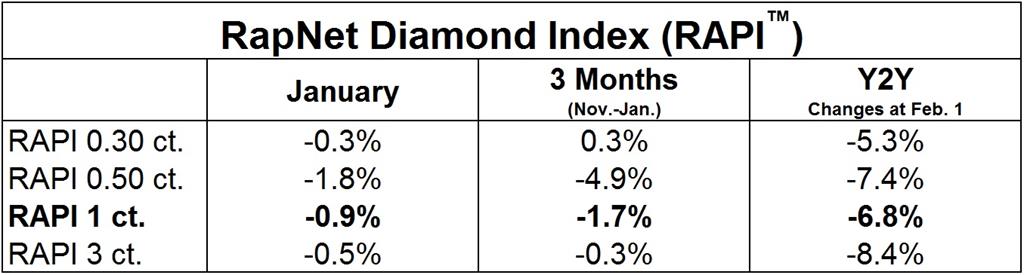

The RapNet Diamond Index (RAPI™) for 1-carat diamonds fell 0.9% in January and was down 6.8% from a year ago.

© Copyright 2017, Rapaport USA Inc.

According to the Rapaport Monthly Report – February 2017, polished supply is projected to rise in the first quarter following a spike in rough demand. Manufacturers ended last year with low inventory, having reduced production since Diwali, and are ramping up operations to satisfy an expected rise in polished trading.

De Beers sold $720 million worth of rough in January, its largest sight since July 2014, according to Rapaport records, with average prices rising 2% to 3%.

Mining companies are preparing for higher rough demand this year and are raising rough production. Global output was flat in 2016 as declines at De Beers and ALROSA were offset by increases at Rio Tinto, Dominion Diamond Corporation and Petra Diamonds. We expect global production to rise 5% to 10% this year considering the new mines and expansion programs in place.

Rough supply is not supported by activity in the polished and jewelry retail sectors. Signet Jewelers and Tiffany & Co. reported disappointing holiday sales as middle-income consumers shifted to lower price points and stores struggled to compete with ecommerce. Luxury jewelers Cartier, Van Cleef & Arpels and Bulgari performed well, while Asian jewelers signaled sales in China may improve in the ‘Year of the Rooster.’

Polished suppliers are expected to resist buyers pushing for deeper discounts following the increase in rough prices. That may be challenging as additional supply becomes available. The industry should tread cautiously in the rough market, as it did last year, if polished demand and price stability is to be sustained throughout 2017.

The Rapaport Monthly Report can be purchased at store.rapaport.com/monthly-report.

Rapaport Media Contacts: media@diamonds.net

U.S.: Sherri Hendricks +1-702-893-9400

International: Gabriella Laster +1-718-521-4976

Mumbai: Manisha Mehta +91-97699-30065

About the Rapaport RapNet Diamond Index (RAPI™): The RAPI is the average asking price in hundred $/ct. of the 10% best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet – Rapaport Diamond Trading Network. www.RapNet.com has daily listings of over 1.2 million diamonds valued at approximately $8 billion. Additional information is available at www.diamonds.net.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added value services that support the development of ethical, transparent, competitive and efficient diamond and jewelry markets. Established in 1976, the Group has more than 16,300 clients in over 120 countries. Group activities include Rapaport Information Services, providing the Rapaport Price List, research, analysis and news; RapNet – the world's largest diamond trading network; Rapaport Laboratory Services provides GIA and Rapaport gemological services in India, Belgium and Israel; and Rapaport Trading and Auction Services specializing in recycled diamonds and jewelry. Additional information is available at www.diamonds.net.

|

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, Bulgari, Cartier, De Beers, diamonds, Jewelry, Rapaport, RAPI, Tiffany

|

|

|

|

|

|

|

|

|

|

|

|

|