|

|

Who Are the Top Rough Buyers?

And where's it all going?

Jul 26, 2018 9:04 AM

By Avi Krawitz

|

|

|

In this excerpt from the latest issue of the Rapaport Research Report, we list the 124 companies buying from De Beers, Alrosa, Rio Tinto and Dominion.

RAPAPORT... Much has been said about the journey a diamond takes from

mine to market, particularly as the industry is increasing its provenance

claims and tracking goods along the pipeline. While an estimated 80% to 90% of

diamonds are cut and polished in India, they’re typically not sent directly

from the mining centers to the factories.

Rather, they stop in the trading centers along the way,

with a large proportion of goods being sent to both Antwerp and Dubai before

reaching Surat for manufacturing.

That marks a notable change in the diamond journey from

less than 10 years ago. Back then, for example, De Beers sent its production

from its mines in Botswana, South Africa, Namibia and Canada to London for

sorting and sales. The goods were then shipped to Antwerp and traded before transportation

to the factories, with the average rough diamond changing hands four or five

times before being cut and polished, one dealer told Rapaport News.

After De Beers moved its sorting operations and sight

location to Gaborone in 2013, the journey changed course, with Botswana

emerging as an important rough sales center. At the same time, some traders moved

to Dubai due to tax and banking difficulties in Antwerp.

Antwerp still remains the most important rough trading

hub, and has maintained its critical mass of rough activity, as noted in the

May issue of the Rapaport Research Report. An estimated 84% of all rough

passes through Antwerp, with many of the smaller and medium-size miners holding

auctions there. But Dubai has emerged as the second largest rough trading

center in recent years.

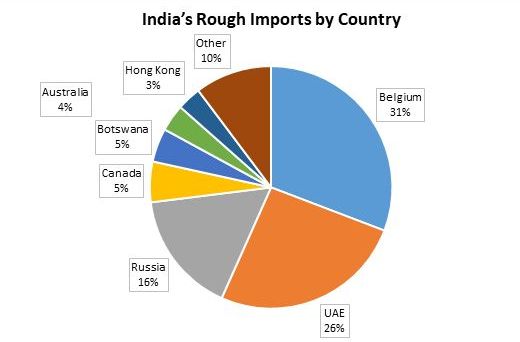

Goods from both centers are largely then passed on to

India, with Belgium accounting for some 31% of India’s rough supply in fiscal

2017, and the UAE contributing 26% of the total (see chart below).

Approximately one-third of India’s supply was sent directly from the mining

centers.

Based on data from India’s

Commerce Ministry.

Russia and Botswana are naturally among the largest

sources of rough supply to India and Belgium, given that they’re the location

of Alrosa and De Beers sales, respectively.

Who’s buying production?

These trends are evident in the locations of the major

buyers of rough diamonds, as presented in the following pages of this report. Below,

we list the companies that have long-term contracts or preferential supply agreements

with the top miners.

Not all diamond mining companies have the scale of

production to provide the consistency of supply that the large manufacturers

require for continuity in their operations. Manufacturers also need guarantees

to ensure polished supply to their jewelry wholesale and retail clients, who

often run programs with specific needs.

Most junior and midsize miners sell via spot auctions or

tenders, whereby buyers compete for rough in a bidding process. Only De Beers,

Alrosa, Rio Tinto and Dominion Diamond Mines — which account for an

estimated 70% of global supply volume — have the scale of production that

enables them to guarantee a scheduled, consistent supply of rough to a set

group of clients.

Between them, they’re supplying 124 diamond companies, many

of which are buying from multiple sources. Among those companies, 41 are

headquartered in India, 38 in Belgium, followed by Israel with 15, seven in

each of Russia and the US, and six based in Hong Kong. Other locations include South Africa, Namibia and Switzerland.

De Beers sells an estimated 90% of its production through

its long-term contracts with sightholders, with the current contract set to end

in March 2019.The remaining 10% is sold

at its auctions. The company has 67 global sightholders, 17 in Botswana, six in

South Africa, nine in Namibia, one in Canada and three receiving industrial

rough supply. Sightholders in southern Africa have to manufacture the majority

of their supply in those countries. De Beers also makes available any excess

supply – known as ex-plan – to 14 accredited buyers across its various

sights.

Alrosa sells about 70% of its production through

long-term contracts in its Alrosa Alliance program. It has 55 companies on the

program and nine “Other” Alliance members who are candidates to become

contracted buyers and can use any Alrosa branding in their own marketing.

Along with the 18 Rio Tinto Select Diamantaires and 26

companies buying from Dominion on a consistent basis, these manufacturers

represent the premium buyers of rough on the market. How they buy and trade

rough and sell the resulting polished sets the tone of the diamond market, and

determines the path along which the diamond takes in its journey along the

pipeline.

| Company Name |

Head Office |

De Beers |

Alrosa |

Dominion |

Rio Tinto |

| A. Dalumi Diamonds |

Israel |

GSS, Botswana |

|

|

|

| A.B.T. Diamonds |

Israel |

Accredited Buyer (GSS) |

|

|

|

| A.C. Diam |

Belgium |

|

Alrosa Alliance |

|

|

| Aives (Excel Overseas) |

India |

|

Alrosa Alliance |

|

|

| Almod Diamonds |

USA |

GSS, Namibia |

|

|

|

| Ankit Gems |

India |

GSS, Namibia |

|

|

|

| Arjav Diamonds |

Belgium |

GSS, Botswana |

Alrosa Alliance |

|

|

| Arodiam Manufacturing Company |

Belgium |

GSS, South Africa |

|

|

|

| Arslanian Group |

Belgium |

|

Alrosa Alliance |

|

|

| Asian Star Company |

India |

GSS |

Alrosa Alliance |

Dominion |

Select Diamantaire |

| Aspeco Belgium |

Belgium |

|

Alrosa Alliance |

|

|

| Blue Gems |

Belgium |

|

Alrosa Alliance |

|

|

| Blue Star Diamonds |

India |

GSS, Botswana |

|

Dominion |

|

| Brilliant Gems |

Belgium |

|

Alrosa Alliance |

|

|

| Brilliant Trading Company (1974) |

Hong Kong |

|

Alrosa Alliance |

|

|

| Bronner Trading Company |

Hong Kong |

|

Alrosa Alliance |

|

|

| Choron Diamonds |

Belgium |

Accredited Buyer (GSS) |

|

|

|

| Chow Sang Sang Jewellery Company |

Hong Kong |

GSS |

Alrosa Alliance Other |

|

|

| Chow Tai Fook Jewellery Company |

Hong Kong |

GSS |

Alrosa Alliance |

|

Select Diamantaire |

| Classic Diam |

Belgium |

|

|

Dominion |

|

| Crossworks Manufacturing |

Canada |

GSS, Namibia, Canada |

|

|

|

| D Navinchandra Gems |

Belgium |

GSS |

|

|

|

| Dali Diamond Company |

Belgium |

GSS |

Alrosa Alliance |

|

|

| DDK |

Russia |

|

Alrosa Alliance |

|

|

| De Toledo Diamonds |

Israel |

Accredited Buyer (GSS) |

|

|

|

| Dharmanandan Diamonds |

India |

GSS |

Alrosa Alliance |

|

|

| Diacor International |

South Africa |

GSS, Botswana, South Africa, Namibia |

|

|

|

| Diajewel |

Belgium |

|

Alrosa Alliance |

Dominion |

|

| Diamant Impex |

Belgium |

GSS |

|

|

|

| Diambel |

Belgium |

GSS |

|

|

Select Diamantaire |

| Diamond India |

India |

|

Alrosa Alliance |

|

|

| Diamtrade |

Belgium |

|

|

Dominion |

|

| Dianco |

Belgium |

GSS |

Alrosa Alliance |

|

Select Diamantaire |

| Diapur |

India |

|

Alrosa Alliance |

|

|

| Diarough Sourcing |

Belgium |

GSS |

Alrosa Alliance |

|

|

| Dimexon International Holdings |

India |

GSS |

Alrosa Alliance |

|

Select Diamantaire |

| DYS Diamond Manufacturers |

Namibia |

Namibia |

|

|

|

| Eloquence Corporation |

USA |

GSS Industrial |

|

|

|

| EPL Diamond |

Russia |

|

Alrosa Alliance |

|

|

| Espeka |

Belgium |

|

Alrosa Alliance |

|

|

| Eurostar Diamonds Traders |

Belgium |

GSS, Botswana |

|

|

|

| EZ Diamonds |

Israel |

GSS |

|

|

|

| Finestar Jewellery & Diamonds |

India |

GSS |

|

|

|

| Fischler Diamonds |

Belgium |

|

Alrosa Alliance |

|

|

| Fruchter Gad Diamonds |

Israel |

GSS |

|

|

|

| Gemmata |

Belgium |

|

|

|

Select Diamantaire |

| Gold Star Diamond |

India |

Accredited Buyer (GSS) |

|

|

|

| Gomel PO Kristall |

Russia |

|

Alrosa Alliance |

|

|

| H Dipak & Company |

India |

GSS |

|

|

|

| Hard Stone Processing |

Namibia |

Namibia |

|

|

|

| Hari Darshan Exports |

India |

GSS |

|

|

|

| Hari Krishna Exports |

India |

GSS |

Alrosa Alliance |

Dominion |

Select Diamantaire |

| Hasenfeld-Stein |

USA |

GSS |

|

|

|

| HVK International |

India |

GSS |

Alrosa Alliance |

|

|

| I.D.R.P. |

Belgium |

|

Alrosa Alliance |

Dominion |

|

| IGC Group |

Belgium |

GSS, Botswana |

|

|

|

| Jasani Gems |

India |

GSS |

Alrosa Alliance |

|

|

| Jewelex India |

India |

GSS |

|

|

|

| Julius Klein Diamonds |

USA |

GSS, Botswana, South Africa, Namibia |

|

|

|

| K. Girdharlal International |

India |

GSS |

|

|

|

| Kapu Gems |

India |

|

Alrosa Alliance Other |

Dominion |

Select Diamantaire |

| Karp Impex |

India |

GSS |

Alrosa Alliance |

|

|

| KGK Diamonds |

India |

GSS, Botswana, South Africa |

Alrosa Alliance |

Dominion |

Select Diamantaire |

| Kiran Exports |

Belgium |

Accredited Buyer (GSS & Botswana) |

|

|

Select Diamantaire |

| Kiran Gems |

India |

GSS, Botswana |

Alrosa Alliance |

Dominion |

|

| Komal Gems |

Belgium |

|

|

Dominion |

|

| KP Sanghvi & Sons |

India |

GSS |

Alrosa Alliance |

|

Select Diamantaire |

| Kristall Diam Company |

Russia |

|

Alrosa Alliance |

|

|

| Kristall Production Corporation |

Russia |

|

Alrosa Alliance |

|

|

| L&N Diamond Manufacturers |

Israel |

|

Alrosa Alliance |

|

|

| L. M. Van Moppes & Sons |

UK |

GSS Industrial |

|

|

|

| Laurelton Diamonds Belgium |

Belgium |

GSS, Botswana |

Alrosa Alliance |

Dominion |

Select Diamantaire |

| Laxmi Diamond |

India |

GSS |

Alrosa Alliance Other |

|

|

| Lazare Kaplan International |

Belgium |

Accredited Buyer (GSS & Namibia) |

|

|

|

| Lazurit-D |

Russia |

|

Alrosa Alliance Other |

|

|

| Leo Schachter International |

Israel |

GSS, Botswana |

Alrosa Alliance |

|

|

| Lieber & Solow |

USA |

GSS Industrial |

|

|

|

| LLD Diamonds |

Israel |

|

Alrosa Alliance |

|

|

| Luk Fook Diamond (International) Company |

Hong Kong |

|

Alrosa Alliance Other |

|

|

| M. Suresh Company |

India |

GSS, Botswana |

Alrosa Alliance Other |

Dominion |

|

| Mahendra Brothers Exports |

India |

GSS |

|

Dominion |

|

| Mohit Diamonds |

India |

GSS |

Alrosa Alliance Other |

|

|

| Motiganz Diamond Group |

Israel |

Accredited Buyer (GSS, Botswana) |

|

|

|

| Niru Diamonds Israel (1987) |

Israel |

GSS |

Alrosa Alliance |

|

|

| Penford (Israel) |

Israel |

|

Alrosa Alliance |

|

|

| Pluczenik Diamond Company |

Belgium |

GSS, Botswana, Namibia |

Alrosa Alliance |

|

|

| Pratham International DMCC |

India |

|

|

Dominion |

|

| Premier Diamond Alliance |

USA |

GSS |

|

|

|

| Priti Gems Exports |

India |

|

|

|

Select Diamantaire |

| Red Exim |

India |

|

|

Dominion |

|

| Richold S.A. |

Switzerland |

GSS |

Alrosa Alliance Other |

|

|

| Rosy Blue |

Belgium |

GSS |

Alrosa Alliance |

Dominion |

|

| Rosy Blue (India) |

India |

GSS |

Alrosa Alliance |

|

|

| S. Vinodkumar Diamonds |

India |

GSS |

|

|

|

| S.D. Diamond |

Russia |

|

Alrosa Alliance |

|

|

| S.V. Gems |

Belgium |

|

Alrosa Alliance |

Dominion |

|

| Safdico International |

Mauritius |

GSS, Botswana, South Africa |

|

|

|

| Sahar Atid Diamonds |

Israel |

GSS |

Alrosa Alliance |

|

|

| Schachter and Namdar |

South Africa |

Accredited Buyer (South Africa & Namibia) |

|

|

|

| Shairu Gems Diamonds |

India |

GSS |

|

|

|

| Sheetal Manufacturing Company |

India |

GSS |

Alrosa Alliance |

|

Select Diamantaire |

| Shree Ramkrishna Exports |

India |

GSS |

Alrosa Alliance |

Dominion |

Select Diamantaire |

| Shri Hari Gems |

India |

|

|

|

Select Diamantaire |

| Signet Direct Diamond Sourcing |

USA |

Botswana |

Alrosa Alliance |

|

Select Diamantaire |

| Simoni Gems |

Belgium |

|

|

Dominion |

|

| Singh Diamonds |

India |

|

|

Dominion |

|

| Soradiam |

Belgium |

|

|

Dominion |

|

| Star Diamond Group |

Belgium |

|

Alrosa Alliance |

|

|

| Star Rays |

India |

GSS |

|

Dominion |

|

| Suashish Diamonds |

India |

Accredited Buyer (GSS) |

|

|

|

| Sunnex |

Belgium |

|

|

Dominion |

|

| Swintu Diam |

Belgium |

|

Alrosa Alliance |

|

|

| Taché |

Belgium |

GSS, Botswana, South Africa |

Alrosa Alliance |

|

|

| Tasaki & Company |

Japan |

GSS |

|

|

|

| Trau Bros |

Belgium |

GSS, Namibia |

Alrosa Alliance |

|

|

| V.D. Global |

India |

GSS |

Alrosa Alliance Other |

|

|

| Venus Jewel |

India |

GSS |

Alrosa Alliance |

Dominion |

Select Diamantaire |

| Vijay Diamond |

UAE |

GSS |

|

|

|

| Vishindas Holaram |

India |

GSS |

|

Dominion |

|

| Wing Hang Diamond Company |

Hong Kong |

Accredited Buyer (GSS) |

Alrosa Alliance |

|

|

| Yaelstar |

Belgium |

GSS |

|

|

|

| Yerushalmi Bros Diamonds |

Israel |

GSS, Botswana |

|

|

|

| Yoshfe Diamonds International |

Israel |

GSS |

|

|

|

| Yosi Glick Diamonds (2003) |

Israel |

GSS |

|

|

|

This article first appeared in the July edition of the Rapaport Research Report. To download a copy of the report, click here and log in with your username and password. Not yet a subscriber? Learn more and subscribe today.

Main image: Shutterstock

|

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, Avi Krawitz, De Beers, Dominion, Dominion Diamond Mines, Rapaport News, Rio Tinto, rough, Rough Diamonds, Sightholders

|

|

|

|

|

|

|

|

|

|

|

|

|