|

|

Price Decline Fueling Diamond Trade Uncertainty

1ct. RAPI -3.8% in September

Oct 6, 2022 4:08 AM

By Rapaport

|

|

|

RAPAPORT PRESS RELEASE, October 6, 2022, Las Vegas… Polished trading was slower than usual in September as US economic uncertainty and the slowdown in China affected sentiment. Dealers were cautious as polished prices continued to slide.

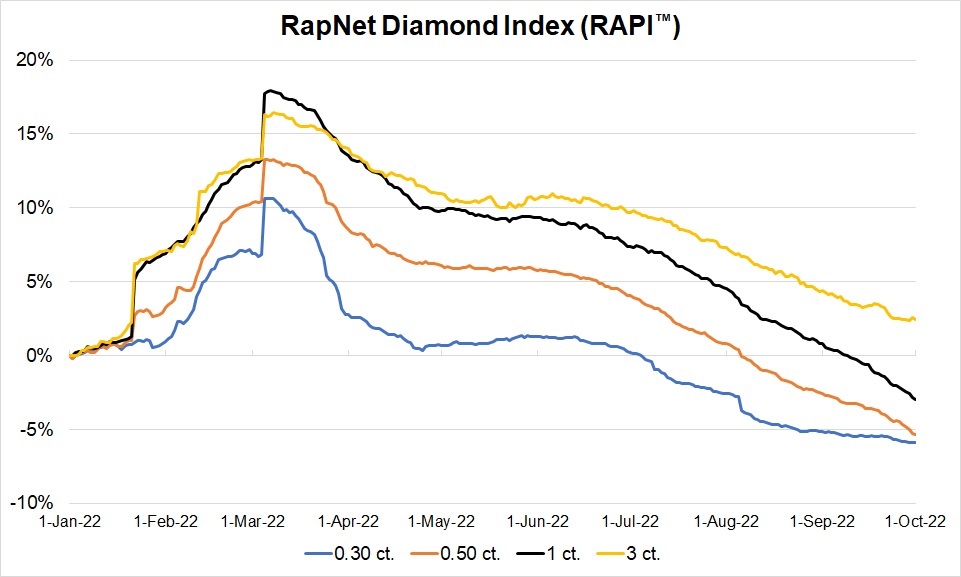

The RapNet Diamond Index (RAPI™) for 1-carat diamonds fell 3.8% in September. Having declined 9.7% in the third quarter, it was down 3% from the beginning of the year as of October 1.

| RapNet Diamond Index (RAPI™) |

|

September |

Year to date

Jan. 1 to Oct. 1 |

Year on year

Oct. 1, 2021, to Oct. 1, 2022 |

| RAPI 0.30 ct. |

-0.7% |

-5.9% |

-5.1% |

| RAPI 0.50 ct. |

-2.8% |

-5.3% |

-4.3% |

| RAPI 1 ct. |

-3.8% |

-3.0% |

2.8% |

| RAPI 3 ct. |

-1.9% |

2.5% |

13.7% |

© Copyright 2022 by Rapaport USA Inc.

Polished inventory levels remain high despite the drop in rough supply following sanctions on Russian miner Alrosa. The number of diamonds on RapNet came to 1.88 million on October 1, a 10% rise year on year. Inventory grew as trading slowed in the third quarter. Manufacturers’ large rough purchases at the end of 2021 and the beginning of 2022 also contributed to the buildup.

Rough demand declined in September. Manufacturers had enough inventory to see them through Diwali, which falls on October 24. De Beers kept rough prices stable at its September sight. Goods were selling at lower premiums on the secondary market; prices fell at rough auctions as buyers left large quantities of goods on the table.

The Jewellery & Gem World Singapore show, which took place in September, boosted Far East sentiment. However, Chinese demand remains sluggish. Consumers there are being more frugal amid continued Covid-19 restrictions.

US jewelers are optimistic for the holiday season but hesitant to buy inventory while polished prices are declining. Retailers are taking more goods on memo and demanding shorter delivery times from suppliers.

Mastercard expects jewelry sales to rise 2.2% in November-December. For many, the holiday season begins in October, as more shoppers are making early purchases to avoid the last-minute rush. Jewelers are focused on enhancing their sales propositions by combining digital and in-store platforms and tapping into their suppliers’ online inventory. This caters to consumers’ desire for greater convenience and a more interactive shopping experience.

Rapaport Media Contacts: media@diamonds.net

US: Sherri Hendricks +1-702-893-9400

International: Avital Engelberg +1-718-521-4976

About the RapNet Diamond Index (RAPI™): The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet® (www.rapnet.com). Additional information is available at www.diamonds.net.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added-value services that support the development of ethical, transparent, competitive and efficient diamond and jewelry markets. Established in 1976, the group has more than 20,000 clients in over 120 countries. Group activities include Rapaport Information Services, providing the Rapaport benchmark Price List for diamonds, as well as research, analysis and news; RapNet, the world’s largest diamond trading network; Rapaport Trading and Auction Services, the world’s largest recycler of diamonds, selling over 400,000 carats of diamonds a year; and Rapaport Laboratory Services, providing Rapaport gemological services in India and Israel. Additional information is available at www.diamonds.net.

|

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, De Beers, diamonds, jewellery, Jewelry, Rapaport, RAPI

|

|

|

|

|

|

|

|

|

|

|

|

|