Top Stories

BHP Makes $38.8 Billion Bid for Anglo American

De Beers Group owner's shares jumped 12% to a market valuation of $41B following bid.

What’s Causing China’s Diamond Slump?

Diamonds in China are underperforming other jewelry categories amid economic and cultural changes affecting Chinese consumer habits.

Most Popular

Spotlight on Estate Jewelry: Best of Rapaport Magazine

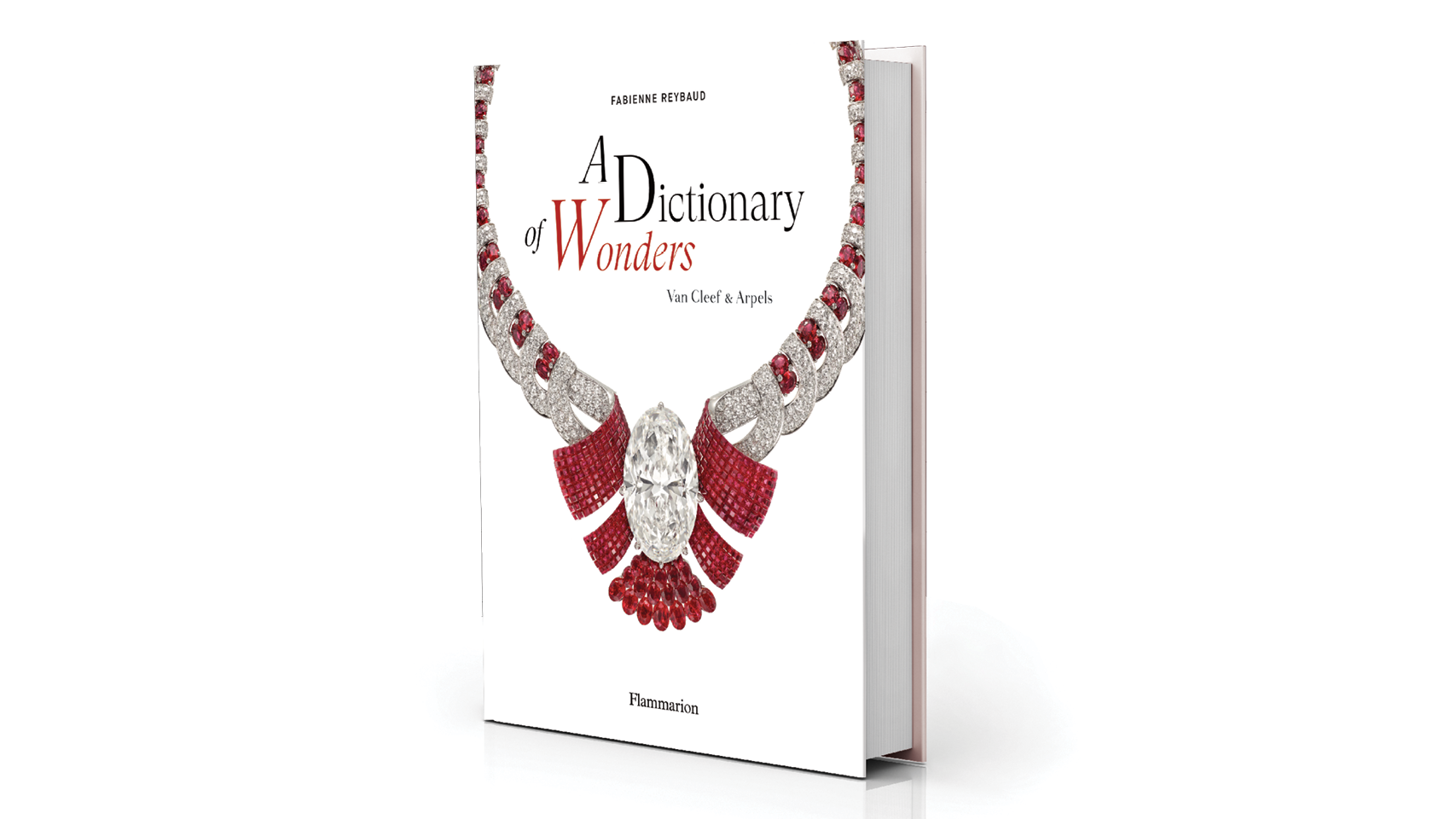

The Big Book of Van Cleef & Arpels

A ‘dictionary’ of Van Cleef & Arpels’s glorious creations showcases the jewels and techniques that have made the maison famous.

Jewelry

April 2, 2024

What’s New at Hancocks

An upgraded location for the London icon lets it sell its rare antique and vintage jewels in style.

Jewelry

April 2, 2024

Geoff Hess of Sotheby’s Talks Vintage Timepieces

Face to Face: The auction house’s head of watches for the Americas reflects on the latest trends and connoisseurs’ most coveted models.

Watches

April 2, 2024

Rapaport

Market Data

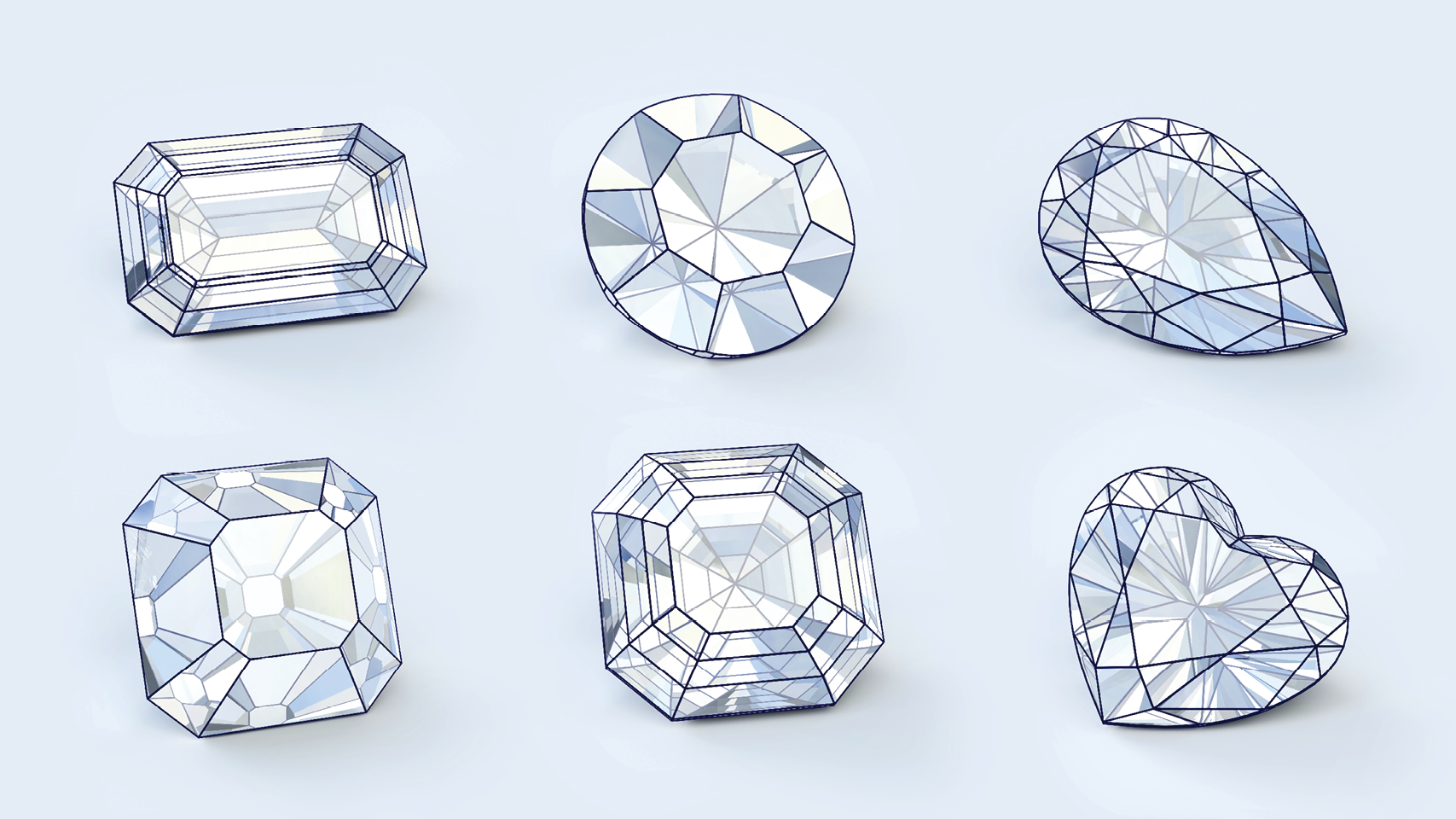

Diamonds

Metals

Currencies

Equities

Market Comment - Apr. 25, 2024

Market quiet. Reduced trading activity in US, Belgium and Israel during Passover festival.

US and Indian retail in seasonal slowdown.

China diamond demand weak.

De Beers 1Q production -23% YOY to 6.9M cts., sales -49% to 4.9M cts.; miner moves auction headquarters from Singapore to Botswana.

Rio Tinto 1Q diamond production -22% YOY to 740K cts. due to Diavik plane crash that led to pause in operations.

Gold price continues to rise. AWDC names Karen Rentmeesters interim CEO following Ari Epstein resignation.

Country comments will return next week after Passover.