|

|

Gem Diamonds Profit Soars After Sales Rebound

Mar 11, 2021 4:50 AM

By Rapaport News

|

|

|

RAPAPORT... Gem Diamonds has proposed paying its first dividend since 2016 after annual profit more than doubled on the back of a sales recovery.

Net profit jumped to $24.3 million for 2020, compared with $10.6 million in 2019, the miner reported Thursday. The company, which owns the Letšeng deposit in Lesotho, was one of the few major diamond producers to record revenue growth for the year, with sales up 4.2% at $189.6 million.

“The quick return to production, Letšeng’s top-quality diamonds, and our excellent relationships with our customers allowed us to sell diamonds and generate revenue when many other producers could not,” said Gem Diamonds CEO Clifford Elphick. “Despite the pressure on the diamond market, these factors helped us to achieve a 17% higher overall average price per carat than in 2019.”

The company resumed mining operations “as fast as we could” following first-half lockdowns, enabling it to limit the slide in output for the year, it said. It also introduced flexible tender processes, featuring live sales in Antwerp and Tel Aviv, as well as virtual viewings, helping buyers participate while travel restrictions were in place. In addition, the miner unearthed 16 diamonds greater than 100 carats during the year, compared to 11 in 2019 — a further boost to revenue.

Sales slid in the first half during the peak of the Covid-19 crisis. However, the miner benefited from a market recovery and higher rough prices in the second half, supporting sales and propelling the overall average selling price for the year to $1,908 per carat.

Gem Diamonds directors have recommended paying dividends of $0.025 on June 15, the company added. Shareholders must approve the decision at the company’s annual general meeting.

The miner suspended dividends in 2016 due to market conditions. In late 2019, when the company decided to maintain that policy, a quarter of stock owners voted against reelecting Elphick to the board.

“2020 was a good set of numbers, which beat our estimates,” investment bank Berenberg commented. “The dividend is something which we thought may happen, and we think that this will be positively received by the market this morning.”

Gem Diamonds’ stock price rose 5% in early trading Thursday.

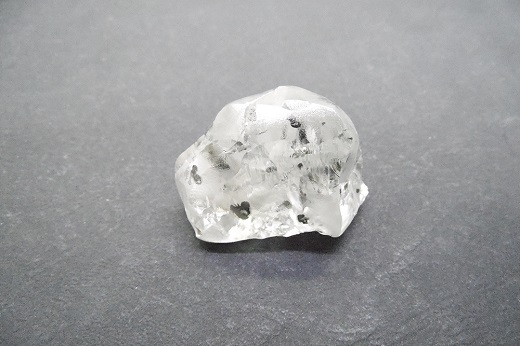

Image: A 233-carat rough stone Gem Diamonds recovered in August 2020. (Gem Diamonds)

|

|

|

|

|

|

|

|

|

|

Tags:

Antwerp, Berenberg, Clifford Elphick, COVID-19, dividends, Gem Diamonds, Lesotho, Letšeng, mining, Rapaport News, rough, Rough Diamonds, Rough markets, rough sales, Tel Aviv

|

|

|

|

|

|

|

|

|

|

|

|

|