|

|

Rapaport TradeWire November 17, 2016

Nov 17, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

November 17, 2016

|

|

|

Indian

diamond industry under pressure with severe liquidity crisis as government

drastically reduces money supply by invalidating 500 and 1,000 rupee currency.

Rough trading slow with De Beers $470M Nov. sale smallest of the year. ALROSA

Oct. rough sales $431M. Sotheby’s Geneva sells $136M (87% by lot) with

emerald-cut, 17.07 ct., fancy intense pink, VVS1 diamond sold to Graff for $21M

($1.2M/ct.). Christie’s Geneva sells $97M (77% by lot) with pear-shape, 9.14

ct., fancy vivid pink, VS2 diamond fetching $18M ($2M/ct.). Belgium Oct.

polished exports -17% to $775M, rough imports -7% to $897M. JBT reports number

of U.S. jewelry businesses -5% to 27,142 in 3Q. |

|

| Diamonds |

1,265,368 |

| Value |

$7,866,721,772 |

| Carats |

1,353,401 |

| Average Discount |

-30.32% |

www.rapnet.com

|

|

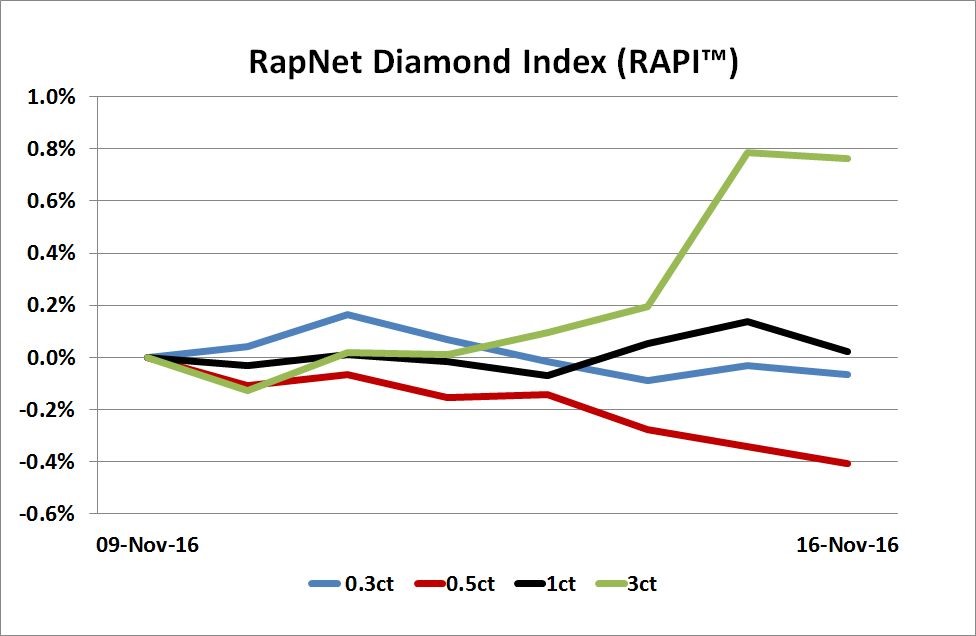

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

The market is totally immune to the macro environment.

The market is totally immune to the macro environment.

Rahul Kadakia, international head of the Christie's jewels department, on the consistent allure of colored diamonds, quoted by CNBC

|

|

|

|

MARKETS

|

|

|

|

| |

United

States: Dealers

filling Christmas orders are maintaining firm prices. Difficult to negotiate

terms with suppliers for memo goods. Steady demand for 0.70 to 2 ct., G-J,

VS2-SI2 diamonds…

Belgium: Market

sentiment positive and trading steady as dealers fill holiday orders. Improving

European luxury demand for 1 to 2 ct., D-G, IF-VVS RapSpec A2+ diamonds…

Israel:

Steady

U.S. demand before holiday season. Dealer trading slow but November better than

October…

India: Cautious

mood as jewelry demand and diamond trading slows due to government

demonetization program. Lack of liquidity mutes activity…

Hong

Kong: Polished

trading slow with selective demand for Hong Kong Christmas season. Steady

demand for 1 ct., G-J, VS1-SI2 diamonds…

Click here for deeper analysis

|

|

|

|

INSIGHTS

|

|

|

|

| |

India's Attack on Cash

Prime Minister Narendra Modi’s demonetization program has far-reaching consequences for the diamond and jewelry trade...

Click here to continue reading

|

|

|

|

INDUSTRY

|

|

|

|

| |

Graff Splashes $37M on Sotheby's Pink Diamonds

Sotheby's

sold $136 million worth of jewels at its Geneva auction. The top lot was a

step-cut, 17.07-carat, fancy intense pink, VVS1 diamond ring, which sold to

Graff Diamonds for $20.8 million, or $1.2 million per carat. Graff also bought

a pear-shaped, 13.20-carat, fancy intense pink, internally flawless diamond, valued

at $16.2 million, or $1.2 million per carat. The Sky Blue Diamond, a

square-cut, 8.01-carat, fancy vivid blue, VVS1 Cartier ring, was purchased by

an anonymous buyer for $17.1 million, or $2.1 million per carat, at the lower

end of its pre-sale estimate. The auction sold 87% by lot.

Sotheby's

sold $136 million worth of jewels at its Geneva auction. The top lot was a

step-cut, 17.07-carat, fancy intense pink, VVS1 diamond ring, which sold to

Graff Diamonds for $20.8 million, or $1.2 million per carat. Graff also bought

a pear-shaped, 13.20-carat, fancy intense pink, internally flawless diamond, valued

at $16.2 million, or $1.2 million per carat. The Sky Blue Diamond, a

square-cut, 8.01-carat, fancy vivid blue, VVS1 Cartier ring, was purchased by

an anonymous buyer for $17.1 million, or $2.1 million per carat, at the lower

end of its pre-sale estimate. The auction sold 87% by lot.

|

| |

Christie’s Geneva Sells Pink Diamond for $18M

Christie’s

netted $97.1 million at its Geneva auction with a pink diamond also topping the

bill. The pear-shaped, 9.14-carat, fancy

vivid pink, VS2 diamond sold to an unidentified Asian buyer for $18.2 million,

or $2 million per carat. The auction house set a new world record for a

pair of earrings, selling two pear-shaped, D-color, flawless diamonds for

$17.6 million ($170,000 per carat). The diamonds weighed 52.55 carats and 50.47

carats respectively. The auction was 77% sold by lot.

Christie’s

netted $97.1 million at its Geneva auction with a pink diamond also topping the

bill. The pear-shaped, 9.14-carat, fancy

vivid pink, VS2 diamond sold to an unidentified Asian buyer for $18.2 million,

or $2 million per carat. The auction house set a new world record for a

pair of earrings, selling two pear-shaped, D-color, flawless diamonds for

$17.6 million ($170,000 per carat). The diamonds weighed 52.55 carats and 50.47

carats respectively. The auction was 77% sold by lot. |

| |

416 U.S. Jewelers Close Shop in 3Q

Jewelry

business closures in the U.S. increased 31% to 416 nationwide in the third

quarter, according to data from the Jewelers Board of Trade (JBT). Most

companies had “ceased operations,” which means they closed for reasons other

than financial difficulty or consolidation. These totaled 392, representing a

42% jump from a year ago. Bankruptcies crept up to 10 cases from nine a year

earlier.

Jewelry

business closures in the U.S. increased 31% to 416 nationwide in the third

quarter, according to data from the Jewelers Board of Trade (JBT). Most

companies had “ceased operations,” which means they closed for reasons other

than financial difficulty or consolidation. These totaled 392, representing a

42% jump from a year ago. Bankruptcies crept up to 10 cases from nine a year

earlier.

|

| |

Belgium’s Rough and Polished Trading Falls

Belgium’s

polished diamond exports dropped 17% from a year ago to $775.2 million in

October, while polished imports fell 10% to $796 million. Net polished exports

swung to negative $20.8 million from positive $50.8 million a year ago. Rough

imports dropped 7% to $897.4 million, while rough exports slumped 29% to $721.1

million. Net rough imports stood at $176.3 million compared with negative $54.2

million a year earlier. Belgium’s net diamond account, representing total

polished and rough imports less total exports, stood at negative $197.1 million

for the month, versus positive $105 million in October 2015.

Belgium’s

polished diamond exports dropped 17% from a year ago to $775.2 million in

October, while polished imports fell 10% to $796 million. Net polished exports

swung to negative $20.8 million from positive $50.8 million a year ago. Rough

imports dropped 7% to $897.4 million, while rough exports slumped 29% to $721.1

million. Net rough imports stood at $176.3 million compared with negative $54.2

million a year earlier. Belgium’s net diamond account, representing total

polished and rough imports less total exports, stood at negative $197.1 million

for the month, versus positive $105 million in October 2015. |

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Jewelry Ads Give Contrasting Messages

Forevermark,

Tiffany & Co and Kay Jewelers released video commercials ahead of the

holiday season, showing contrasting approaches to entice consumers. Forevermark

and Kay’s campaigns promoting their respective ‘Ever Us’ two-stone collections

feature couples in their daily interactions, targeting millennials. Tiffany’s

holiday commercial follows a more traditional model, focusing on the glamour

and shine of a diamond.

Forevermark,

Tiffany & Co and Kay Jewelers released video commercials ahead of the

holiday season, showing contrasting approaches to entice consumers. Forevermark

and Kay’s campaigns promoting their respective ‘Ever Us’ two-stone collections

feature couples in their daily interactions, targeting millennials. Tiffany’s

holiday commercial follows a more traditional model, focusing on the glamour

and shine of a diamond. |

| |

Holiday Sales to Gain from Post-Election Certainty

Retail

sales during the U.S. holiday season will increase between 2.1% and 2.5% over

last year, magnified by the relatively low base in 2015, Standard & Poor’s

predicted. The forecast covered general merchandise, apparel and accessories,

furniture and other retail sales. Sales this season will benefit from increased

certainty after the disruptive U.S. presidential elections, commentators said

while remaining cautious about the extent of any potential upturn.

Retail

sales during the U.S. holiday season will increase between 2.1% and 2.5% over

last year, magnified by the relatively low base in 2015, Standard & Poor’s

predicted. The forecast covered general merchandise, apparel and accessories,

furniture and other retail sales. Sales this season will benefit from increased

certainty after the disruptive U.S. presidential elections, commentators said

while remaining cautious about the extent of any potential upturn.

|

| |

Alex and Ani Appoints President

Alex

and Ani named Cindy DiPietrantonio its president to oversee strategy and lead

daily operations. DiPietrantonio (pictured), who joined the jewelry

company in July as interim chief operating officer, will report to Carolyn

Rafaelian, its founder and CEO. DiPietrantonio previously served as interim

president of SHEEX Performance Bed Sheets and Sleepwear where she helped raise sales by more than 400%, Alex

and Ani said.

Alex

and Ani named Cindy DiPietrantonio its president to oversee strategy and lead

daily operations. DiPietrantonio (pictured), who joined the jewelry

company in July as interim chief operating officer, will report to Carolyn

Rafaelian, its founder and CEO. DiPietrantonio previously served as interim

president of SHEEX Performance Bed Sheets and Sleepwear where she helped raise sales by more than 400%, Alex

and Ani said.

|

| |

Alibaba Sells Record $18B in Single Day

Sales

on Alibaba Group’s Alipay platform jumped 32% on Singles’ Day, underlining the

day’s growing importance on the Chinese retail calendar. The total value of

transactions hit $17.8 billion (RMB 120.7 billion) compared to $14.3 billion

last year, Alibaba reported. The major shopping day, also called “11.11” since

it falls on November 11, is being marketed as an occasion for single consumers

to buy products for themselves.

Sales

on Alibaba Group’s Alipay platform jumped 32% on Singles’ Day, underlining the

day’s growing importance on the Chinese retail calendar. The total value of

transactions hit $17.8 billion (RMB 120.7 billion) compared to $14.3 billion

last year, Alibaba reported. The major shopping day, also called “11.11” since

it falls on November 11, is being marketed as an occasion for single consumers

to buy products for themselves.

|

|

|

|

MINING

|

|

|

|

| |

De Beers Sells $470M in Quiet November Sight

De

Beers recorded its smallest sight of the year in November amid a seasonally

quiet period for the rough diamond market. The ninth sales cycle of 2016

totaled $470 million compared with $178 million a year ago when the rough

market was in the doldrums. Premiums on the secondary market were about 5% for

higher-quality goods but sightholders noted prices softened on news of the Indian

government’s move to scrap 500 and 1,000 rupee notes.

De

Beers recorded its smallest sight of the year in November amid a seasonally

quiet period for the rough diamond market. The ninth sales cycle of 2016

totaled $470 million compared with $178 million a year ago when the rough

market was in the doldrums. Premiums on the secondary market were about 5% for

higher-quality goods but sightholders noted prices softened on news of the Indian

government’s move to scrap 500 and 1,000 rupee notes.

|

| |

ALROSA October Sales Hit $431M

ALROSA

reported rough diamond sales totaled $430.8 million in October as demand

remained strong despite disruptions caused by Diwali. The figure

represents a decline from $435.1 million a month ago but is still relatively

high for this time of year. October is seasonally slower because Indian

manufacturers limit rough buying so they are not overstocked when factories close for Diwali in November.

ALROSA

reported rough diamond sales totaled $430.8 million in October as demand

remained strong despite disruptions caused by Diwali. The figure

represents a decline from $435.1 million a month ago but is still relatively

high for this time of year. October is seasonally slower because Indian

manufacturers limit rough buying so they are not overstocked when factories close for Diwali in November. |

| |

Lucara Sells 224ct. Rough for $11M

Lucara

Diamond Corp garnered $38.7 million from the sale of 12 “exceptional” stones

recovered at its Karowe mine in Botswana. The top lot in the tender

was a 224.5-carat, type IIa diamond which sold for $11.1 million, or $49,497

per carat. Five diamonds sold for more than $2 million each. A 162.3-carat

stone drew $4.9 million, while an 81.8-carat diamond garnered $3.8 million.

Lucara

Diamond Corp garnered $38.7 million from the sale of 12 “exceptional” stones

recovered at its Karowe mine in Botswana. The top lot in the tender

was a 224.5-carat, type IIa diamond which sold for $11.1 million, or $49,497

per carat. Five diamonds sold for more than $2 million each. A 162.3-carat

stone drew $4.9 million, while an 81.8-carat diamond garnered $3.8 million. |

| |

Lace Diamond Mines Put into ‘Business Rescue’

DiamondCorp subsidiary Lace Diamond Mines (LDM) was placed into “business

rescue,” after severe weather forced the company to halt production and request

a suspension of its shares. LDM will formally appoint a business rescue

practitioner in due course, the miner said. The deposit in South Africa

was flooded after almost 90 millimeters of rain fell in just over an hour on

November 11.

DiamondCorp subsidiary Lace Diamond Mines (LDM) was placed into “business

rescue,” after severe weather forced the company to halt production and request

a suspension of its shares. LDM will formally appoint a business rescue

practitioner in due course, the miner said. The deposit in South Africa

was flooded after almost 90 millimeters of rain fell in just over an hour on

November 11.

|

|

|

|

GENERAL

|

|

|

|

| |

JA: Trump Election Won't Impact Proposed Tax Bill

Jewelers

of America (JA) said attempts to achieve tax “fairness” in the U.S. should be

unaffected by the Republican Party’s continued control of the Senate. The

tussle to pass the Marketplace Fairness Act will continue in 2017 and

the Senate could consider the legislation before President-Elect Donald Trump

takes office in January, according to JA. At present, online sellers such as

Amazon and eBay can avoid charging and collecting sales tax in states where

they do not have a warehouse or another physical presence.

Jewelers

of America (JA) said attempts to achieve tax “fairness” in the U.S. should be

unaffected by the Republican Party’s continued control of the Senate. The

tussle to pass the Marketplace Fairness Act will continue in 2017 and

the Senate could consider the legislation before President-Elect Donald Trump

takes office in January, according to JA. At present, online sellers such as

Amazon and eBay can avoid charging and collecting sales tax in states where

they do not have a warehouse or another physical presence.

|

| |

Smithsonian Showcases Diavik Foxfire

A record-breaking rough diamond found in Canada has come on display at the Smithsonian National Museum of

Natural History in Washington D.C., appearing until February 16. The Diavik Foxfire is the largest gem-quality rough diamond recovered in Canada, according to Rio

Tinto, which owns 60% of the Diavik mine. The

diamond was sold in June to Deepak Sheth of Amadena Investments LLC/Excellent

Facets Inc., which chose to keep it in its rough form.

A record-breaking rough diamond found in Canada has come on display at the Smithsonian National Museum of

Natural History in Washington D.C., appearing until February 16. The Diavik Foxfire is the largest gem-quality rough diamond recovered in Canada, according to Rio

Tinto, which owns 60% of the Diavik mine. The

diamond was sold in June to Deepak Sheth of Amadena Investments LLC/Excellent

Facets Inc., which chose to keep it in its rough form. |

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Indian jewelry stocks fell this past week as investors feared the potential impact of the government's decision to invalidate 500 and 1,000 rupee notes. The declines were led by Gitanjali Gems (-20%). U.S. retail stocks were mostly solid, headed by Kohl's (+18%), amid reasonably positive expectations for the upcoming holiday season. Macy's (+9%), Movado Group (+10%) and Nordstrom (+11.5%) also made healthy gains this week. European luxury and mining stocks were mixed.

View the detailed industry stock report

| |

Nov 17 (12:00 GMT) |

Nov 10 (13:22 GMT) |

Chng. |

|

| $1 = Euro |

0.93 |

0.92 |

0.01 |

|

| $1 = Rupee |

67.80 |

66.74 |

1.07 |

|

| $1 = Israel Shekel |

3.85 |

3.84 |

0.02 |

|

| $1 = Rand |

14.27 |

13.84 |

0.43 |

|

| $1 = Canadian Dollar |

1.34 |

1.35 |

-0.01 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,230.57 |

$1,279.66 |

-$49.09 |

-3.8% |

| Platinum |

$945.50 |

$983.00 |

-$37.50 |

-3.8% |

| Silver |

$17.05 |

$18.59 |

-$1.54 |

-8.3% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

26,227.62 |

27,517.68 |

-1,290.06 |

-4.7% |

| Dow Jones |

18,868.14 |

18,589.69 |

278.45 |

1.5% |

| FTSE |

6,769.24 |

6,890.61 |

-121.37 |

-1.8% |

| Hang Seng |

22,262.88 |

22,839.11 |

-576.23 |

-2.5% |

| S&P 500 |

2,176.94 |

2,163.26 |

13.68 |

0.6% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Cautious

mood as jewelry demand and diamond trading slows due to government

demonetization program. Lack of liquidity mutes activity. Smaller companies

under pressure. Large diamond and jewelry exporters better positioned, with

steady U.S. and Chinese demand as rupee -3% in past week to INR 68/$1. Dealer

demand for small, low-quality rough declines after currency ban. Factories

still closed for Diwali to reopen Nov. 21.

Read the Polished Diamond Trading Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|