|

|

Rapaport TradeWire December 31, 2015

Dec 31, 2015 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

December 31, 2015

|

|

|

U.S. consumer

confidence improves with overall holiday retail sales +7.9%, according to

MasterCard SpendingPulse. Mobile and online sales soar. Diamond trade cautious

about the Chinese New Year as China-Hong Kong jewelry sales slowed in 2015.

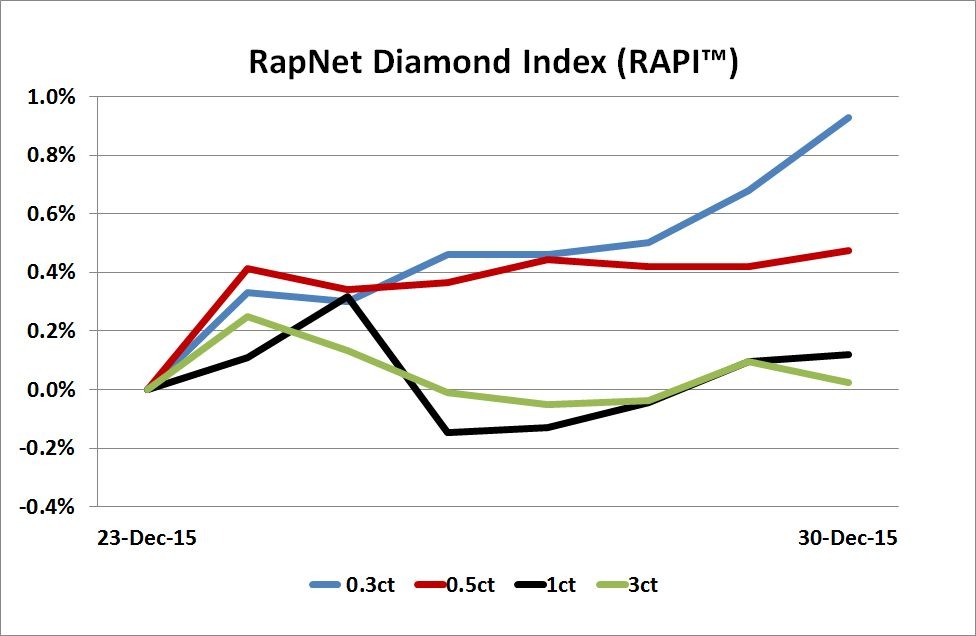

RAPI for 1ct. diamonds +1.5% in December as difficult year ends on a positive

note. Polished prices supported by shortages rather than rise in demand.

Dealers more optimistic but profit concerns continue into 2016. Cutters not

willing to raise polished production at current rough prices. The Rapaport Price List is not being published this

week (Jan. 1). The Rapaport Group wishes

everyone a happy, healthy, prosperous and peaceful New Year.

|

|

| Diamonds |

1,043,455 |

| Value |

$7,546,193,201 |

| Carats |

1,186,710 |

| Average Discount |

-28.37% |

www.rapnet.com

|

|

| The RapNet Diamond Index (RAPI) is the average price for the top 25 diamond qualities (D-H, IF-VS2). It is based on the 10 best priced diamonds for each quality. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

|

|

|

MARKETS

|

|

|

|

| |

United States: Polished trading quiet as

wholesalers and dealers took vacation between Christmas and New Year. Sentiment

improving amid reports of a positive holiday shopping season and some orders

for Valentine’s Day...

Belgium: Polished and rough

trading very quiet with most dealers on vacation during the Christmas to New

Year period. Antwerp bourses are closed until January 4...

Hong Kong: Polished market quiet over

Christmas-New Year with many dealers on vacation. Some trading activity

to fill orders from Mainland China for the Chinese New Year (Feb. 8)...

India: Positive sentiment in

the market. Prices firm due to shortages in RapSpec A2 (3X, none) diamonds while

holiday demand was okay. Good U.S. demand for 1ct., G-J, SI2-I2 diamonds...

Israel: Polished trading stable

and sentiment continues to improve. Steady demand with shortages supporting

prices for RapSpec A2 (3X, none) 0.30-0.90ct., D-J, VS-SI and 1ct., G-J, SI-I2

diamonds...

Click here to continue reading

|

|

|

|

HAPPY NEW YEAR

|

|

|

|

|

|

|

INDUSTRY

|

|

|

|

| |

UAE Pact to Supervise Rough Trade

The Ministry of Economy of the

United Arab Emirates (UAE) and the Dubai Multi-Commodities Centre (DMCC) have

agreed to enhance coordination so that the supervision of the country’s rough

diamond trade will be in line with the Kimberley Process (KP) Certification

Scheme.

The Ministry of Economy of the

United Arab Emirates (UAE) and the Dubai Multi-Commodities Centre (DMCC) have

agreed to enhance coordination so that the supervision of the country’s rough

diamond trade will be in line with the Kimberley Process (KP) Certification

Scheme.

The memorandum of understanding comes as the UAE

is about to take chairmanship of the KP on January 1, 2016.

|

| |

Lazare Kaplan Subject to SEC Action

The Securities and Exchange Commission (SEC) has

filed administrative proceedings against Lazare Kaplan International Inc.

alleging the New York diamond manufacturing firm failed to submit periodic

reports since February 2009.

The Securities and Exchange Commission (SEC) has

filed administrative proceedings against Lazare Kaplan International Inc.

alleging the New York diamond manufacturing firm failed to submit periodic

reports since February 2009.

The SEC will consider whether to suspend trading

in the company’s shares for up to 12 months or revoke its registration,

according to a filing December 8.

In a response December 21, the company said

successfully resolving "material uncertainties" would

let the company finalize its financial statements and file the relevant forms.

|

| |

FTC Seeks Feedback on Jewelry Guides

The

Federal Trade Commission (FTC) is seeking comments by April 4, 2016, on the

latest draft of proposed changes to the FTC Guides for the Jewelry Industry.

The

Federal Trade Commission (FTC) is seeking comments by April 4, 2016, on the

latest draft of proposed changes to the FTC Guides for the Jewelry Industry.

The FTC proposes to revise its guidance on below-threshold alloys,

precious metal content of products containing more than one precious metal,

surface application of precious metals, lead-glass filled stones, synthetic

diamonds, pearl treatments, varietals and misuse of the word ‘gem,’ an FTC

statement said.

|

| |

IDE Appoints Advisory Council, New Board

Yoram Dvash, the new president of the Israel Diamond

Exchange (IDE), has set up a Presidents' Consultative Council body comprising leading

industry figures.

Yoram Dvash, the new president of the Israel Diamond

Exchange (IDE), has set up a Presidents' Consultative Council body comprising leading

industry figures.

Former presidents Shmuel Schnitzer, Avi Paz and Yair

Sahar, who are all honorary presidents of the IDE, are joined on the new

council by Jacob (Kobi) Korn, president of the Israel Diamond Manufacturers

Association (IsDMA) and a recent acting president of the IDE; and Moti Ganz, chairman

of the Israel Diamond Institute and a former president of IsDMA. They will hold

regular meetings to advise Dvash on current matters.

Dvash also appointed a new board and chairs of committees

after being elected mid-December. Yehezkel Blum, formerly vice president of the

IDE, is now executive vice president, while Shalom Papir has been appointed

senior deputy president.

|

| |

Bank Opens Dubai Diamond Financing Base

The

National Bank of Fujairah (NBF) opened its diamond financing office in the

Dubai Multi Commodities Centre (DMCC). This comes after the United Arab

Emirates bank set up a diamond financing team in April 2015 to fund

manufacturers and traders of rough and polished stones.

The

National Bank of Fujairah (NBF) opened its diamond financing office in the

Dubai Multi Commodities Centre (DMCC). This comes after the United Arab

Emirates bank set up a diamond financing team in April 2015 to fund

manufacturers and traders of rough and polished stones.

The unit, based in the Almas Tower, has more

than 70 clients, according to the bank. The

facility was inaugurated by Ahmed Sultan Bin Sulayem, executive chairman of the

DMCC, and senior figures from the NBF and the DMCC.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

U.S. Holiday-Season Sales +8%

U.S.

retail sales grew 7.9% during the shopping season from Black Friday to

Christmas Eve, according to the MasterCard SpendingPulse. The survey tracks

sales using cards, cash and checks, excluding automobiles and gasoline purchases.

U.S.

retail sales grew 7.9% during the shopping season from Black Friday to

Christmas Eve, according to the MasterCard SpendingPulse. The survey tracks

sales using cards, cash and checks, excluding automobiles and gasoline purchases.

Ecommerce was among the biggest winners this

holiday season, growing about 20% from a year ago, MasterCard Advisors said December 28. According to the company’s recent Omnishopper Guide,

70% of U.S. consumers report doing more research online than before.

|

| |

Amazon Mobile Shopping Soars this Holiday

Customers

shopping on Amazon's mobile app more than doubled this holiday, with nearly 70

percent of the ecommerce giant’s clientele using a mobile device to shop. On

Cyber Monday, the first major online shopping day of the season, customers

worldwide ordered more than 33 electronics items per second from a mobile

device.

Customers

shopping on Amazon's mobile app more than doubled this holiday, with nearly 70

percent of the ecommerce giant’s clientele using a mobile device to shop. On

Cyber Monday, the first major online shopping day of the season, customers

worldwide ordered more than 33 electronics items per second from a mobile

device.

The number of members of Amazon Prime, the

online retailer’s paid-for service, who shopped via mobile more than doubled in

the U.S. this season, Amazon said.

|

| |

U.S. Jewelry & Watch Sales +3%

U.S. jewelry and watch sales

from all retail outlets increased 3.3% year on year to an estimated $6.9

billion in November 2015, according to provisional figures from the Bureau of

Economic Analysis.

U.S. jewelry and watch sales

from all retail outlets increased 3.3% year on year to an estimated $6.9

billion in November 2015, according to provisional figures from the Bureau of

Economic Analysis.

Jewelry sales in November increased 3.3 per cent

year on year to $6.1 billion, according to Rapaport

News estimates –

beating the October growth rate of 1.9%.

Watch sales rose 3.8% to $811 million year on

year. Both categories have seen seven consecutive months of growth after five

straight months of decline between December 2014 and April 2015.

|

| |

Millennials Still Desire Diamonds

Millennials are almost twice as likely as

non-millennials to have bought diamond jewelry as a holiday gift, according to

a survey carried out by the Diamond Producers Association (DPA).

Millennials are almost twice as likely as

non-millennials to have bought diamond jewelry as a holiday gift, according to

a survey carried out by the Diamond Producers Association (DPA).

More than a quarter of men gave diamond jewelry

to their partner last holiday season, while this year one third said

they planned to, according to the DPA, which polled 400 consumers with annual

household income of $75,000 or more in an online survey immediately after the

Thanksgiving weekend. The respondents were all married or in a committed

relationship, aged 18 to 64, and included a “robust sample” of millennials.

|

| |

Tiffany Tops Survey of 66 U.S. Digital Brands

Tiffany

& Co. topped a ranking of jewelry and watch brands’ digital performance

carried out by business intelligence company L2.

Tiffany

& Co. topped a ranking of jewelry and watch brands’ digital performance

carried out by business intelligence company L2.

The retailer was one of only two brands to

receive a “genius” ranking in the 2015 Digital IQ Index: Watches & Jewelry,

which benchmarks the online strength of 66 brands in the U.S. The other

“genius” brand as per the L2 index was Cartier.

|

|

|

|

MINING

|

|

|

|

| |

Warm Weather Poses Risk to Canada Ice Road

The world's busiest ice road in Canada’s Northwest

Territories is running late because unseasonably warm weather has set back ice

formation on a path that gives access to remote diamond mines during the

winter, Reuters reported December 24.

The world's busiest ice road in Canada’s Northwest

Territories is running late because unseasonably warm weather has set back ice

formation on a path that gives access to remote diamond mines during the

winter, Reuters reported December 24.

The road is still expected to open on schedule

late January. However, if current weather patterns continue, there could either

be more work for crews trying to build the ice, or the road’s already short

period of operation could be cut, the report said.

|

| |

Paragon Shares Delisted from AIM

Paragon Diamonds was delisted from London’s Alternative

Investment Market (AIM) December 29, according to a London Stock Exchange statement of the

same date.

Paragon Diamonds was delisted from London’s Alternative

Investment Market (AIM) December 29, according to a London Stock Exchange statement of the

same date.

The miner had released a statement December 24 saying its shares

would be delisted as negotiations over the funding for its mining operations in

Lesotho were “unlikely” to reach a “conclusion” by year-end.

The company’s directors worked “tirelessly” to secure financing to bring its

Lemphane Kimberlite Pipe Project into production and to enable the miner to

explore the Mothae Kimberlite Resource, according to the December 24 statement.

|

|

|

|

GENERAL

|

|

|

|

| |

Elvis’ Jewelry Up for Auction

Jewelry

and watches owned by Elvis Presley will be among items auctioned at the

American singer and actor’s Graceland home in Memphis, Tennessee, this coming week.

Jewelry

and watches owned by Elvis Presley will be among items auctioned at the

American singer and actor’s Graceland home in Memphis, Tennessee, this coming week.

“The Auction at Graceland” on January 7 will

offer, among a number of pieces, a gold, diamond and rock crystal quartz ring

gifted by Elvis to his friend Linda Thompson, estimated at $15,000 to $20,000.

Also up for bids is a 14-karat gold necklace gifted to bodyguard Sam Thompson

featuring the initials “TCB,” estimated at $12,000 to $15,000, according to

Graceland Auctions.

|

| |

India’s IBJA Plans World Silver Council

The India Bullion and Jewelers Association

(IBJA) plans to launch the World Silver Council in the first week of January, Business

Standard reported.

The India Bullion and Jewelers Association

(IBJA) plans to launch the World Silver Council in the first week of January, Business

Standard reported.

The apex body will include representatives from

domestic and global silver miners, refiners, traders and users, the report said

December 15, citing a senior IBJA official. It will also seek membership from

domestic and global players in the silver market and plans to seek ‘council’

status from the Indian government. No such ‘council’ currently exists for the

silver industry in India, the newspaper said.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

U.S. retail stocks were generally stable or slightly down this past week since Christmas. Kohl's (+2.1%) headed the pack, while Birks Group (-10%) fell the most. Far East stocks were mixed, with Hong Kong’s Chow Tai Fook (+2.2%) and Luk Fook (+1.9%) gaining and Singapore-listed ValueMax Group (-3.3%) heading the declines. Mining stocks were solid overall, but Anglo American (-9%) continued its recent slide. Indian share prices were mixed, with Lypsa Gems (+11%) heading the gains and Goldiam International (-5%) suffering the biggest decline.

View the detailed industry stock report.

| |

Dec. 31 (09:30 GMT) |

Dec. 24 (10:00 GMT) |

Chng. |

|

| $1 = Euro |

0.92 |

0.91 |

0.003 |

|

| $1 = Rupee |

66.22 |

66.07 |

0.2 |

|

| $1 = Israel Shekel |

3.90 |

3.90 |

0.01 |

|

| $1 = Rand |

15.60 |

15.23 |

0.37 |

|

| $1 = Canadian Dollar |

1.39 |

1.39 |

0.00 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,062.48 |

$1,073.90 |

-$11.42 |

-1.1% |

| Platinum |

$871.55 |

$875.75 |

-$4.20 |

-0.5% |

| Silver |

$13.88 |

$14.34 |

-$0.46 |

-3.2% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

26,130.97 |

25,842.44 |

288.53 |

1.1% |

| Dow Jones |

17,603.87 |

17,602.61 |

1.26 |

0.0% |

| FTSE |

6,256.14 |

6,249.53 |

6.61 |

0.1% |

| Hang Seng |

21,914.40 |

22,138.13 |

-223.73 |

-1.0% |

| S&P 500 |

2,063.36 |

2,064.29 |

-0.93 |

0.0% |

| Yahoo! Jewelry |

1,005.71 |

1,007.05 |

-1.34 |

-0.1% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Positive

sentiment in the market. Prices firm due to shortages in RapSpec A2 (3X, none)

diamonds while holiday demand was okay. Good U.S. demand for 1ct., G-J, SI2-I2

diamond. Steady Chinese demand for 0.30-0.40ct., D-J, VS-SI diamonds. Polished

production remains at estimated 30 percent below capacity with tight profitability

due to high rough prices. Manufacturers anticipate 5 to 7 percent rough price

cut in January. Jewelry retail sales stable but consumer confidence still weak.

Read the Polished Diamond Trading Report

|

|

|

Advertisements

|

|

|

Advertisements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|