|

|

Reliance Money, WGC Launch Gold Buying Plan

Nov 22, 2012 6:13 AM

By Dilipp S Nag

|

|

|

RAPAPORT... Reliance Money Precious Metals Private Ltd. (RMPM), a Reliance Capital company, and World Gold Council (WGC) on Thursday launched a plan that allows consumers to accumulate physical gold using a daily average pricing methodology in order to attract consumers from the unorganized jewelry market.

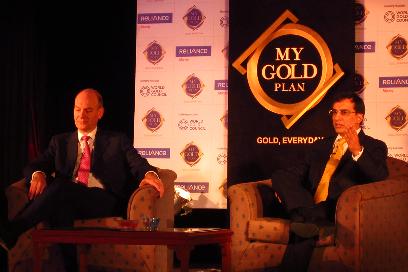

“We have been witnessing a distinct increase in the demand for physical gold backed saving products in the last few years. This change in the gold buying pattern provided us an opportunity to offer Reliance My Gold Plan, the next-generation gold-savings product,” said Vikrant Gugnani (right side in picture), the chief executive of brokerage and distribution business at Reliance Capital.

The plan is available at a minimum subscription of $18 (INR 1,000) per month and can be subscribed to for a period of one year to 15 years, the company stated. Daily average pricing methodology splits the monthly subscription into equal parts and allots gold grams over 20 successive business days, it explained.

Reliance Money stated that at the end of the selected term, customers have the option to exchange their accumulated gold grams for 24-karat gold coins or jewelry at designated outlets across India. The company has partnered with 100 jewelers and plans to increase this number to 1,000 in the next few months.

“The growing demand for gold to mark life's events and special occasions, along with its significance in Indian society, called for a plan which made savings in gold convenient, simple and secure. The World Gold Council has successfully launched similar products in China and Japan,” said Stephen Richardson (left side in picture), the director of investment at WGC. “Reliance Money’s distribution network and extensive experience in handling gold products in India makes them the ideal partner for us.”

Reliance Money noted that the company will manage the product, while the WGC is providing marketing and promotional support. The plan has an administrative charge of 1.5 percent on each subscription, a lock-in period of six months and a pre-maturity charge of 2.5 percent, it added.

*Note: All data was published in rupee. Any references to U.S. dollar amounts were made according to exchange-rate conversions by Rapaport News.

|

|

|

|

|

|

|

|

|

|

Tags:

Dilipp S Nag, gold, India, Jewelry, Reliance Money, Reliance My Gold Plan, Stephen Richardson, Vikrant Gugnani, WGC

|

|

|

|

|

|

|

|

|

|

|

|

|