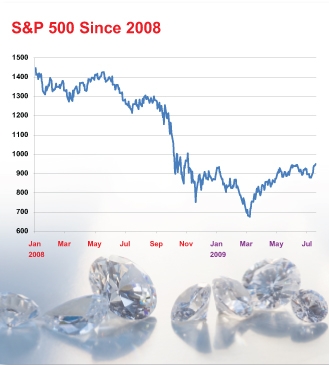

RAPAPORT... Diamond markets quieted, as expected, through July as summer vacations began to take hold. The traditional two-month vacation season, followed by the September Jewish holiday period, provides an opportune time for diamantaires, wholesalers and jewelry retailers to take stock and reassess where their businesses — and the market — are heading, before the all-important fourth quarter. Indeed, this year, no one knows what to expect from Christmas, and reactions to the current quiet period could prove a crucial indicator as to whether the demand for diamonds is on a recovery path, or is playing the proverbial economic “W,” with continued volatility.

The following questions are key in assessing the current market:

• Is the rough market showing signs of stability?

• Has the polished market reached a sustainable level of trade?

• What is driving demand?

• What is happening at the consumer level?

The Rush for RoughDemand for rough diamonds has increased rapidly over the past two to three months, primarily due to the lack of manufacturing at the beginning of the year, the mining companies ceasing production — or keeping rough off the market through stockpiling — and diamantaires depleting their inventories. We saw higher demand at recent rough tenders and at the De Beers Diamond Trading Company (DTC) sights, which more than tripled in the second quarter of 2009, compared with the first.

At the same time, rough prices rose consistently, sparking concerns that another bubble could be in the making. Others saw the increases as a correction from an over-decline in prices during the fourth quarter of 2008, when the recession hit hardest. Petra Diamonds, which operates the Cullinan mine in South Africa, explained that rough prices fell approximately 65 percent from September 2008 to early 2009, but have since bounced back by about 25 percent. The average price of rough stones mined at Gem Diamonds’ high-end Letseng mine rose to $1,496 per carat in the second quarter, up 47 percent from the previous quarter. Similarly, Rockwell Diamonds reported that average prices at its monthly tenders grew from $531 per carat in March to $585 in May, $700 in June and $835 in July.

The good news is that demand is still on the rise, and the July DTC sight saw sightholders “queuing up for goods.” The sight was valued at an estimated $350 million, which was down from the previous month, due to the De Beers shortage of supply rather than the lack of demand. The downside is that demand is being spurred by rough shortages resulting from production cuts and depleted inventories, and not by higher consumer demand down the pipeline. The other strong point is that prices at tender appear to have settled in July. Of deep concern, however, is that the DTC’s increased prices in certain areas again in July were followed by reports that “the DTC would have sold out even if they had raised prices by double,” one sightholder told

Rapaport Diamond Report. That assessment reflects sightholders’ hunger for goods, most of which is coming out of India.

Demand, while up, is still not at highly sustainable levels. As DTC intends to host larger sights in August and September, and as ALROSA is expected to soon resume selling to the market again, not only is there a danger of oversupply, but, should prices continue to rise, another bubble could well burst.

The Polished Market

While diamantaires are paying higher prices for rough, their margins are being cut as prices for polished have, on the whole, remained steady in July, with some discounts on RapNet exceeding 40 percent below list (see graph above). Furthermore, buyers and sellers have become increasingly out of sync on prices, which slowed polished trading during the month. In addition, diamantaires in Israel and Belgium, where bourses officially close for three weeks at the beginning of August, were already moving into vacation mode, adopting an attitude that they would “wait and see toward the end of August,” when markets return to trading again.

Heading EastMany are resting their hopes on the September Hong Kong show, as demand is being driven largely by the Far East market at the moment, particularly after the less-important June show there yielded better-than-expected results. The September show may provide a vital indicator as to the current health of the Hong Kong market. While the U.S. still accounts for approximately half of Israel’s polished exports and roughly a quarter of Belgium’s, Hong Kong is clearly gaining ground, and is firmly established as the second-largest diamond market for both these centers.

This trend is expected to intensify in the next few years, given the growth of Asian economies and the emergence of China — and India for that matter — as major consumer markets. While the rest of the world continues to languish in recession, China’s economy grew at an annual rate of 7.1 percent to $2.1 trillion in the first half of 2009. Furthermore, domestic consumer sales rose 15 percent to $826 billion during the six-month period. The overwhelming reality is that China is increasingly becoming a domestic economy, less reliant on export income from abroad. While this is hardly a positive development for global markets, it is good for the diamond industry, because the one thing China does not mass-manufacture is diamonds. A growing economy with a population of more than 1 billion people should inevitably result in growing wealth and higher spending on diamonds. With that should come some significant growth in diamond imports from manufacturing centers such as India, Belgium and Israel.

In contrast, the economic shakeup of the past nine months has forced Americans to cut back on luxury spending, and the U.S. continues to publish weak macroeconomic data. Unemployment reached a 26-year high of 9.5 percent in June and is expected to continue to rise before it reverses toward the end of 2010. At the retail level, department store sales fell 9.4 percent to $15.4 billion in June, and by 7.7 percent to $84.5 billion in the first half of the year. Total retail sales, including gasoline, retail and food, declined 9 percent to $342.1 billion in June and dropped 9.8 percent to $2 trillion for the first six months of the year.

Not All GloomWhile the numbers are down, it is worthwhile to put them in perspective so as not to undervalue the fact the U.S. is still the world’s largest economy and consumer market — not to mention diamond market.

But trends are changing, and the industry is being forced to adjust accordingly. Furthermore, there appears to be a glimmer of hope that the worst may be over. The Federal Reserve revised its 2009 Gross Domestic Product (GDP) forecast favorably from a decline of 1.3 to 2 percent, a prediction made in April, to a drop of 1 to 1.5 percent. The Fed said it expects GDP to grow by 2.1 to 3.3 percent in 2010. It also projected a continued move toward normal conditions in the financial markets.

Well-Deserved BreakAs diamantaires head for green pastures and beaches in August, they can expect little in the way of surprises from the markets while they are away. Indeed, barring any major political bombshells, the diamond industry should perform in August as it did in July, with an eerie expectation in the air. There is hope for a positive Hong Kong show in September, a busy Diwali season in October and a more upbeat Christmas season to round off the year. After a stressful first two quarters, and what we expect to be an aggressive fourth, now would be an opportune time to breathe.

Article from the Rapaport Magazine - August 2009. To subscribe click here.